Is The U.S. Dollar’s Retreat Sustained?

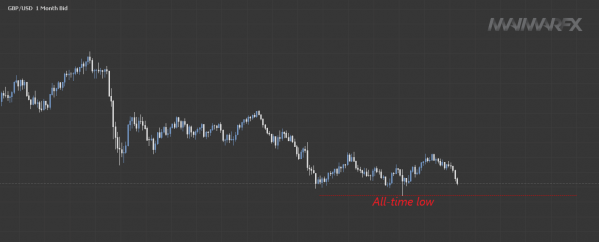

The U.S. dollar has lost ground against other counterparts and some traders already speak of a shift in sentiment from bullish USD to bearish USD. There were no fundamental news headlines supporting the greenback’s pullback but the reason could have been a kind of ‘saturation point’ for dollar bulls after strong gains. In other words, the dollar’s retreat should be taken with a grain of salt, at least as long as important technical barriers (EUR/USD 1.0650, GBP/USD 1.2650) remain unbroken to the upside.

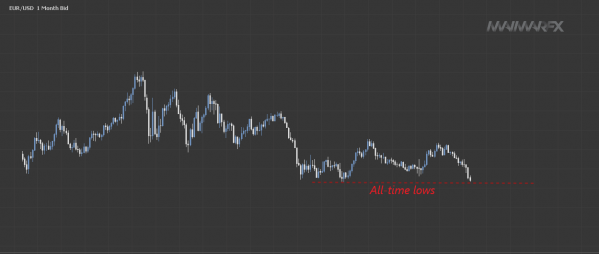

EUR/USD: Consolidation between 1.0650 and 1.0450?

The euro appreciated and traded above 1.05. We will now pay attention to price breakouts either above 1.0660 or below 1.0440.

The best performer yesterday was the British pound which strongly rose against the dollar, testing the 1.25-level. Gains could be even extended towards 1.26 and 1.2650 but below 1.24, we favor a bearish continuation.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

Daily Forex, DAX And Crypto Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: