British Pound Extends Slide While Euro Rebounds

The worst performer yesterday was the British pound which broke below 1.38 and extended its slide towards 1.3720. While the pound’s recent slide can be attributed to profit-taking and the subsequent drop below crucial technical barriers, traders should bear in mind that the pound’s overall upward trend is still intact. If GBP/USD remains above 1.37, we anticipate a rebound towards 1.3850. However, if the March low at 1.3670 breaks, chances are in favor of further bearish momentum with a next lower target at 1.36.

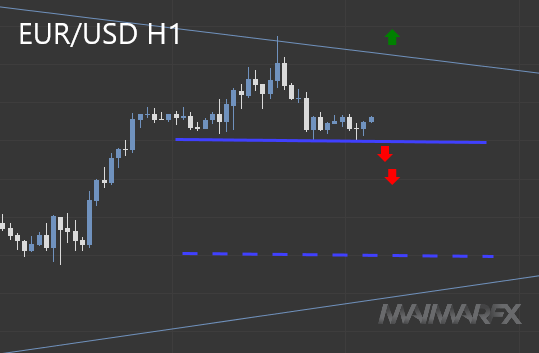

The euro, on the other side, rebounded against the U.S. dollar and tested the 1.1920-resistance area. Bulls will now wait for a renewed break above 1.19 in order to anticipate further gains. If bulls are unable to push the euro above 1.19, the focus shifts to the 1.1860-50-area and a break below that short-term support could lead to further losses towards 1.18. Breaking further below 1.1780, the euro could resume its downward trend towards 1.16.

The DAX found a short-term support at the 100-Day EMA (15160) from where it gained ground and finally ended the day above 15200. Let’s see what the market has to offer today.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: