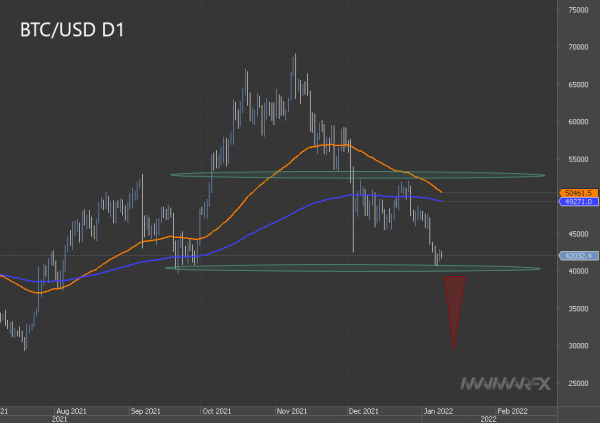

Bitcoin – Flash-Crash bis $30,000 möglich nach einem Fall unter die 40000-Marke?

Der U.S. Arbeitsmarktbericht vom Freitag zeigte im Dezember lediglich 199.000 neue Stellen, weniger als die Hälfte der Prognosen, jedoch sank die Arbeitslosenquote unter 4 Prozent bei einem gestiegenen Lohnwachstum, was auf einen angespannten Arbeitsmarkt hindeutet. Trotz des enttäuschenden Stellenwachstums könnten der Rückgang der Arbeitslosenquote und das stärkere Lohnwachstum eine schnellere Straffung der Geldpolitik rechtfertigen. So wird damit gerechnet, dass die Federal Reserve bereits im März die Zinsen anheben könnte.

U.S. Dollar Bullen zogen sich nach dem NFP-Bericht vom Freitag zurück. Der Fokus in dieser Woche liegt nun auf dem am Mittwoch anstehenden U.S. Inflationsbericht vom Dezember. Die Gesamtinflation wird mit 7,0 Prozent im Jahresvergleich erwartet, wobei die Kerninflation mit 5,4 Prozent prognostiziert wird. Dies wären die höchsten Werte seit 30-40 Jahren. Ein über den Erwartungen liegendes Ergebnis könnte die falkenhaften Fed Spekulationen weiter ankurbeln und damit den Dollar-Trade stärken.

EUR/USD: Das Paar handelt weiterhin über 1.1270 und könnte einen Test von 1.14/1.1420 anstreben. Ein Ausbruch über 1.1430 könnte eventuell sogar zu einer beschleunigten Bullendynamik in Richtung von 1.15 führen. Die Euro Bullen stehen jedoch mehreren Widerständen gegenüber und die Risiken aufgrund der geldpolitischen Divergenz zwischen Europäischer Zentralbank und der Fed tendieren abwärts.

GBP/USD: Sterling Bullen versuchen derweil die Widerstandsmarke bei 1.36 zu überwinden, und sollte dies klappen, sehen wir ein höheres Ziel bei rund 1.3670. In letzter Zeit handelte das Paar jedoch tendenziell im überkauften Bereich, was die Wahrscheinlichkeit einer Korrektur in Richtung 1.3450 erhöht.

Bitcoin – Wahrscheinlichkeit für einen Fall bis $30,000 erhöht nach einem potenziellen Unterschreiten der 40000-Marke

Da die Fed ihren Stimulus zurückzieht und damit dem System Liquidität entzieht, geraten spekulative Vermögenswerte unter Druck. Mit anderen Worten sind Kryptos angesichts der hawkischen Wendung der Fed derzeit anfälliger. Ein nachhaltiger Bruch unter 40000 könnte die Wahrscheinlichkeit eines Flash-Crashs in Richtung 30000 erhöhen. Über 53000 ändert sich die Stimmung hingegen zugunsten der Bullen.

Der Inhalt des Beitrags spiegelt die persönliche Meinung des Autors wider. Dieser übernimmt für die Richtigkeit und Vollständigkeit keine Verantwortung und schließt jegliche Regressansprüche aus. Dieser Beitrag stellt keine Kauf- oder Verkaufsempfehlung dar.

Copyright © 2022 MaiMarFX.

Folgen Sie uns über die sozialen Medien: