New Wave Of Market Volatility To Spill Over Into FX?

Dear traders,

We welcome everyone to a new trading month with new challenges, new opportunities and hopefully good profits.

The Reddit-style enthusiasm from hordes of retail traders has unleashed an unprecedented rally in the market with a jump in demand for silver bars and coins over the weekend. Many retail investors could be motivated by this new market movement and traders should generally brace for further rallies. This new wave of volatility could also spill over into the currency market with the U.S. dollar possibly being a main beneficiary.

On the economic data front this week, we will have the Bank of England rate decision on Thursday, followed by the U.S. January payrolls report on Friday but these key events might take a backseat to volatile retail trading.

Let’s take a look at the technical picture:

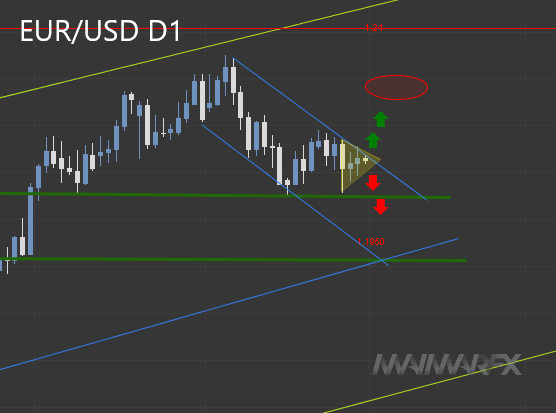

EUR/USD

The euro fluctuated within a narrow price range but there are chances of upcoming price breakouts now. If the pair is able to overcome the 1.2150-mark, a next target will be at 1.22. Above 1.2225, we will focus on the 1.23-resistance. Looking for a bearish breakout, the price will need to fall below 1.21 with a lower target at 1.2050. Below 1.2040 we expect bearish momentum to increase towards 1.1950.

GBP/USD

The cable’s uptrend is still intact and sterling bulls should pay attention to a bullish breakout above 1.3760 which could push the cable higher towards 1.3870. A renewed break below 1.3660, on the other side, could lead to increased bearish momentum.

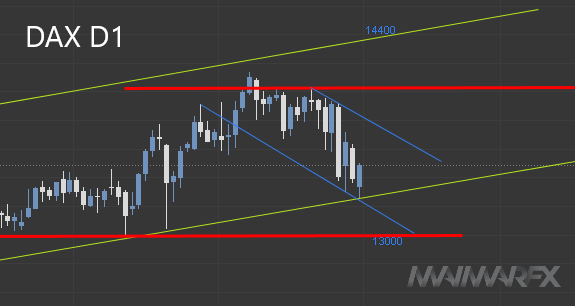

DAX

The index corrected some of its recent gains but remained within its primary uptrend. As long as the index remains above 13200 and more importantly above 13000, we expect the rally to continue with a near-term target at 13800. A renewed break above 14030 could lead to further gains towards 14400.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: