Price Action Leaves Much To Be Desired

This was definitely not the volatility what would be expected from the last large risk event of the year. The price action in the U.S. dollar was noticeably more constrained and there was no traction following the event.

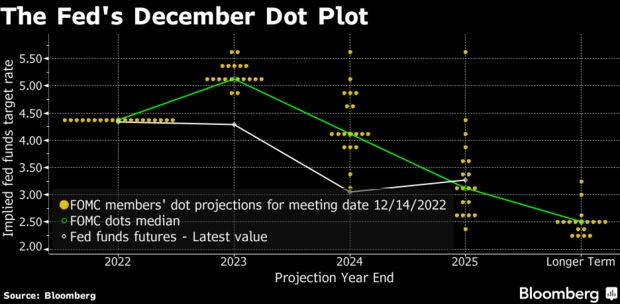

Overall, yesterday’s outcome was in-line with expectations, even though Fed chair Jerome Powell warned the Fed is not close to ending its anti-inflation campaign of rate hikes while saying “we still have some ways o go”. In terms of terminal rates, policymakers projected rates would end next year at 5.1 percent before being cut to 4.1 percent in 2024 (see dot plot). Even though these are higher levels than previously indicated, the market didn’t see reason for a repricing.

The focus now shifts to the Bank of England and European Central bank decisions.

Both central banks are expected to announce a 50bp rate hike today. The BoE is expected to have further to run before hitting its own terminal in 2023 compared to its US counterpart while as for the ECB, there seems more potential for further tightening into 2023. with recession risks remarkably high for Europe and the rest of the world combatting inflation more aggressively, the Eurozone’s policy authority may find it reasonable to tapering its efforts with a lower terminal rate.

EUR/USD: The euro finds itself within the resistance zone between 1.06 and 1.08. The technical outlook has not noticeably changed which is why we still focus on price breakouts either above 1.08 or below 1.0350.

GBP/USD: The cable’s recent upward channel is still intact, showing a price range between 1.25 and 1.2150.

Given the December liquidity drain around the holiday, we do not expect to see larger movements after traction was all but absent even yesterday.

Daily Forex and DAX Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: