Follow The Trend Until It Ends

It’s the worst losing streak in the market since the 2008 financial crisis. Stock markets fall toward bear market, the euro drops toward parity with the U.S. dollar, the cable slides back toward 1.20 and also cryptocurrencies experience a major set-back. Market strategists expect this trend to continue and warn investors to prepare for a recession. While some optimistic traders are buying the dip while trying to pick a bottom, one thing is clear in a sell-off: You won’t know it’s over until long after it ends. And thus, we cannot predict what will happen and whether the sell-off will be over soon but we can follow the trend for now.

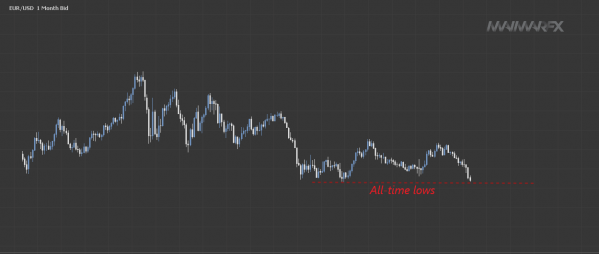

EUR/USD

We believe that the euro could slide even further touching 1.03 before it could try to recover some losses. A current resistance is seen at 1.06. We bear in mind that the pair’s all-time low is at 1.0340. A significant drop below 1.03 could see accelerated bearish momentum toward parity.

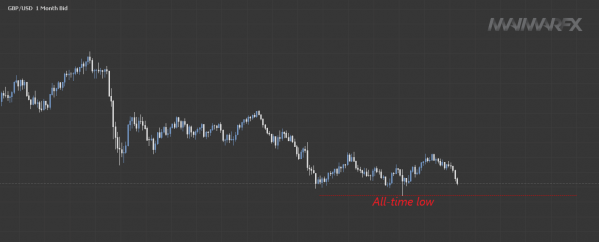

GBP/USD

If the pair is unable to break above 1.23, we see a next lower target at 1.20. The cable’s all-time low is at 1.1409.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: