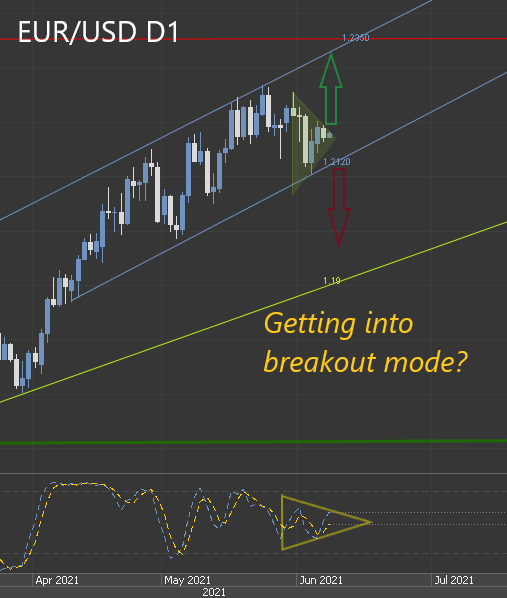

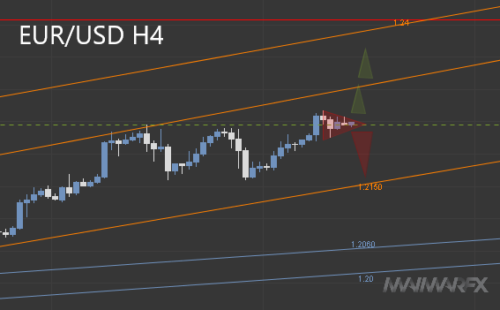

Breakout Pressure

Trading ranges have been extremely narrow in recent days amid low volatility, not only in many currency pairs but also in prominent indices such as the S&P 500 or DAX. After days of these unfavorable trading conditions, breakout pressure is building.

DAX: The index remained above 14400 which could point to an upcoming bullish breakout towards 15000. We will go for greater profits today, after the DAX has spent days in consolidation mode.

GBP/USD: The cable’s support at 1.24 remains intact and following yesterday’s dip towards 1.2420 the pair recovered losses and climbed back towards 1.26. Next bullish breakout levels will be at 1.2615 and 1.2670. A break above 1.2670 could revive bullish momentum with a higher target at 1.2850. Bears will however pay attention to a significant break below 1.24.

Daily Forex, DAX And Crypto Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

Monthly results 2022:

May 2022: +172 pips

April 2022: +111 pips

March 2022: +689 pips

February 2022: +531 pips

January 2022: +766 pips

Results 2021:

December 2021: +61 pips

November 2021: +452 pips

October 2021: +165 pips

September 2021: +578 pips

August 2021: +135 pips

July 2021: +34 pips

June 2021: +264 pips

May 2021: +528 pips

April 2021: +278 pips

March 2021: +45 pips

February 2021: +42 pips

January 2021: +472 pips

Results 2020:

December 2020: +318 pips

November 2020: +75 pips

October 2020: +432 pips

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: