Market’s Sell-Off Intensifies

The market’s sell-off intensified on Wednesday and while we, as day traders, benefit from sharp market moves, the U.S. dollar’s strength is impressive given the threat around the U.S. debt ceiling and the risk of default. The greenback benefits from its role as a safe haven currency but with such a specific fundamental threat, investors should be careful.

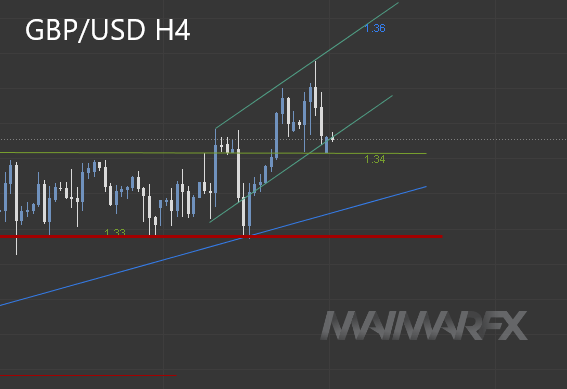

GBP/USD – Pound at risk of sharp declines

The cable broke below all crucial support zones, losing over 2 percent this month while no one can say how low it might go. The mix of supply-chain chaos, faster inflation and the threat of interest rate hikes is causing anxiety among investors. Some investors might fear that an early rate hike will worsen the growth prospects for the U.K. From a technical perspective we know that bearish movements are typically stronger and more unpredictable than bullish movements. We therefore pencil in a next lower target at 1.32. Former supports can now turn into resistances, such as the former 1.36-support.

EUR/USD – We finally got the bearish break!

The euro broke below 1.1670 and headed for a test of the crucial 1.16-mark. Currently we see the pair holding above 1.16 but it could be only a matter of time until 1.16 breaks significantly. We now see a lower target at 1.15, whereas a lower resistance could come in at around 1.1690.

Today is the final trading day of September and our results for this trading month are quite good: +598 pips which is equal to a net profit of $ 2390 by a low-risk management of only 1% per trade.

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: