U.S. Dollar Weakness

After Wednesday turned out to be a very quiet trading day, the U.S. dollar weakened in the afternoon hours which was due to weaker-than-expected economic data and dovish signals from Federal Reserve Chair Jerome Powell in a speech at a forum. Powell downplayed recent high inflation readings and indicated that nothing has really changed for policymakers which could be a sign that the Fed is on track to cut rates as expected by 75bp in 2024.

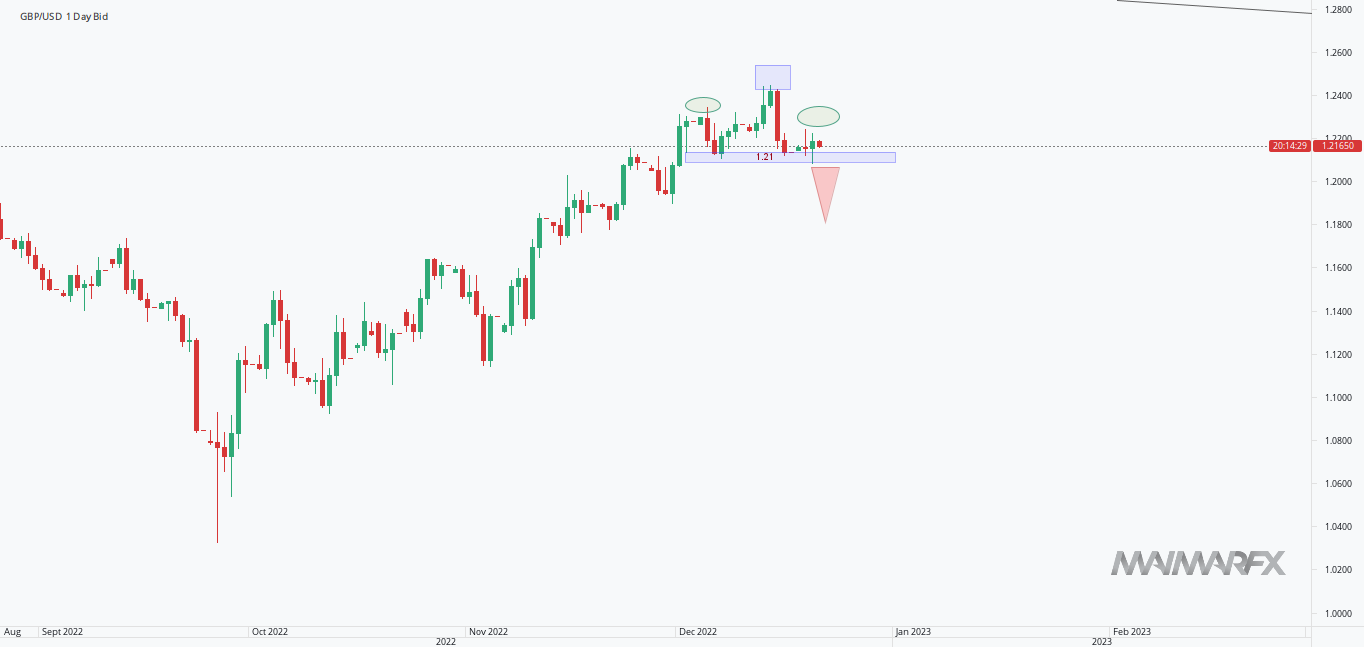

Consequently, the weakness in the greenback led to a surge in the euro and British pound, pushing the euro back above 1.0830 and the pound above 1.26. Whether the dollar’s counterparts can hold above their current supports remains to be seen tomorrow.

The focus will now shift to Friday’s nonfarm payrolls numbers.

Daily Forex and DAX Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.