Have Markets Over-Reacted To Last Week’s Inflation Data?

Welcome to a new trading week. Risk appetite improved around the world after signs of cooling in U.S. inflation and the prospects of a dovish tilt by the Federal Reserve. The U.S. dollar weakened against other counterparts. However, markets may have over exaggerated last week’s inflation print since a few declines in inflation does not mean that inflation pressure is finally over and that the Fed is shifting from hawkish to dovish. The market’s risk appetite could thus be premature with limited upside in both EUR/USD and GBP/USD.

For the British pound, the U.K. will release inflation data on Wednesday.

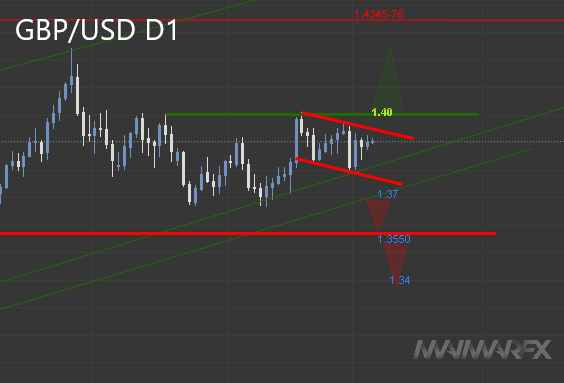

GBP/USD

The shift in global risk sentiment and the large dollar sell-off benefitted the pound and sent sterling soaring, lifting it above 1.16 and further to the 1.17-1.19 resistance zone. Sterling bulls should however be careful. U.K. employment and inflation data are on tab this week, leaving the pound vulnerable.

From a technical perspective, the pair is overbought with the current resistance zone ranging from 1.17 to 1.19. We expect any further gains to be limited to a maximum of $ 1.1940. The most likely scenario in our opinion is a correction towards 1.15/1.1450.

EUR/USD

Speculation for a smaller Fed rate hike in December could keep the pair afloat over the coming weeks. However, the pair is overbought, making it vulnerable for a correction toward the parity level. A bullish breakout above 1.0370 on the other side could see a bullish extension towards 1.06.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: