Quiet Trading Over US Thanksgiving Holiday?

Dear Traders,

The market’s sentiment was recently strongly influenced by political events and while political risks in the Eurozone continue to build up, the euro went into a tailspin. With the Italian constitutional referendum coming in on December 4, the situation for the euro may deteriorate as political risks are rising across Europe.

Trump’s win seems to have reinvigorated populist sentiment across the continent and if the UK can Brexit, the US can elect Trump, it is also possible that France and Italy could pull out of the EU. In this uncertain political environment, the euro remains vulnerable to losses. However, bearing in mind that the euro is oversold in short-term time frames, we expect some corrections in the EUR/USD.

The economic calendar this week is rather light in terms of market-moving data. The U.S. Thanksgiving holiday on Thursday usually leads to low liquidity in the market, which is why we do not expect significant market movements this week. The only interesting piece of U.S. data will be Durable Goods Orders on Wednesday followed by the FOMC Meeting Minutes which are expected to confirm the hawkish tilt of the Federal Reserve. Everything else than a Fed rate hike next month would be a big surprise.

From the Eurozone, we have the PMI Report (Wednesday) and the German IFO Report (Thursday) due for release this week. Furthermore, ECB President Mario Draghi speaks at the European Parliament in Strasbourg today at 16:00 UTC.

Technically we expect the EUR/USD to trade between 1.07 and 1.0530 in the near-term while a break above 1.0720 may invigorate some bullish momentum towards 1.0770 and 1.08 whereas a break below 1.0520 would increase the pressure on the currency pair.

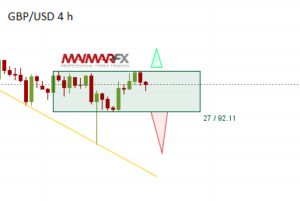

GBP/USD

The pound sterling dropped towards 1.23 and sterling bears are eager to see whether the cable will break below that crucial support. After a break below 1.23 we see a next lower target at 1.2150. A break above 1.2550 however, would shift the bias in favor of the bulls.

From the U.K. , the only interesting piece of economic data will be the Autumn Budget Statement (Wednesday) and Friday’s GDP Report.

Daily Forex signals:

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2016 Maimar-FX.