U.S. Dollar Under Pressure Post-FOMC, Focus Turns To U.S. GDP

The Federal Reserve offered, as expected, no fresh cues and said it will continue with asset purchases. The U.S. dollar started to weaken ahead of the Fed’s statement and accelerated its slide at the central bank’s virtual press conference. However, worries about earlier-than-expected tightening appeared to ease, which could be an early signal of the Fed’s hawkish shift.

Technically, we saw both FX pairs rising on the back of a weakening U.S dollar which was to be expected since there were no surprises from the Fed.

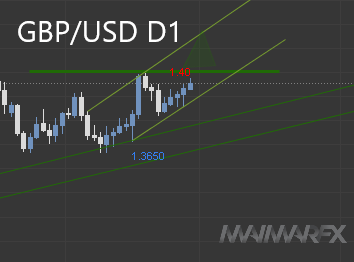

GBP/USD

As long as the pair holds above 1.38, the outlook remains bullish with the focus on the 1.40-reisstance. In case of a bullish breakout above 1.4020 we expect further gains towards 1.4150 and 1.42. Based on the current uptrend channel a higher support is now seen at 1.39.

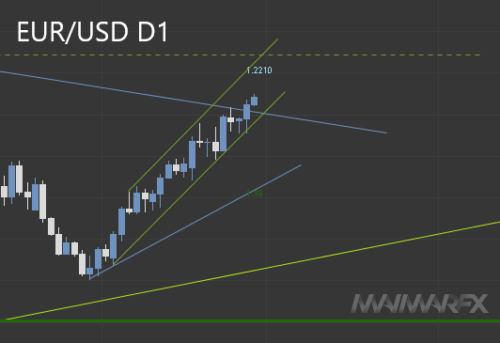

EUR/USD

The euro was able to stabilize above 1.21 and as long as this crucial barrier holds, we see chances of further gains towards 1.22. But be careful: Given the straight-lined uptrend, the pair is in overbought territory and buyers may seek to take profits around 1.2180, so be aware of corrections. If the euro falls back below 1.2050, we could see a deeper correction towards 1.20.

DAX

The index’s price chart looks boring since there were no major fluctuations. Consequently, the current sideways range between 15400 and 15000 remains intact. A break above 15370 could open the door for a leg up towards 15450 and possibly even a renewed test of the high at 15500. Below 15140, we could see a test of the 15000-support.

Traders will watch the U.S. GDP figures today at 12:30 UTC, that could strengthen the greenback in the short-term, provided the reading will not fail to impress.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: