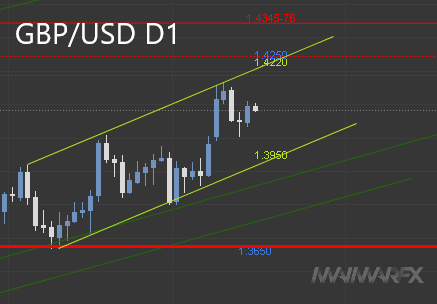

GBP/USD: Set For Another Bullish Breakout?

The U.S. dollar weakened as the risk-on rally continues. Federal Reserve officials indicated that they will continue to raise rates but are open to slowing their tempo. The market’s focus is however on the meaning ‘hawkish slowing’ which is why we saw rallies across the board. The Fed will publish the minutes of their November 1-2 meeting today at 7pm GMT.

Is the GBP/USD headed for a next bull run?

Based on bullish candle stick formation we may a next leg up towards 1.22. The ascending trendline has proved to act as a support and as long as prices remain above 1.18 but more importantly, above 1.17 we favor the upside trend. Next bullish targets are at 1.1950, 1.20 and 1.21.

Our trading ideas for today 23/11/22:

EUR/USD

Long @ 1.0340

Short @ 1.0280

GBP/USD

Long @ 1.1915

Short @ 1.1865

DAX® (GER40)

Long @ 14480

Short @ 14430

Settings for all trades today: Entries from 8:00 am UTC, SL 25, TP 40

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: