Pound And DAX Sell-Off – Next Targets To Watch Out

Tuesday saw a broad-based sell-off on concerns about inflation. More specifically, concerns over the debt-ceiling impasse added to the fresh bout of risk aversion. The U.S. dollar benefited.

Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen warned in a Senate hearing that a U.S. default due to a failure to raise the debt ceiling would have catastrophic consequences. Republicans blocked a move to raise the debt limit.

The worst performer was the British pound that sold off as investors turned cautious on surging energy prices and panic-buying.

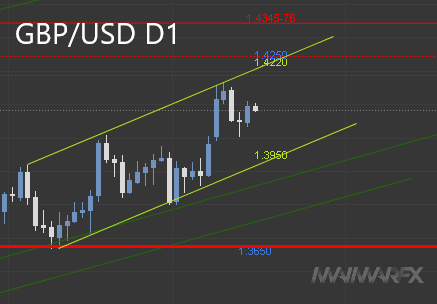

GBP/USD – Risk-aversion sent the pair tumbling

The cable broke below 1.36 and headed towards 1.35. We now see the pair within a crucial support zone ranging from 1.36 until 1.3450. We expect some rebound as long as 1.3450 holds.

DAX – Bring it down

The index reversed course after 15700 proved to be difficult to overcome. Traders now eye the crucial 15000-support followed by 14900. If 14800 breaks, we get a sell signal with a lower target around 14300.

EUR/USD – Where is the breakout?

The euro refrained from a technical breakout while prices are confined to a very narrow range. We keep an eye on a upside move above 1.17 to anticipate a higher target at 1.1740, or on the downside, a break below 1.1670 that could lead to further losses towards 1.1630.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: