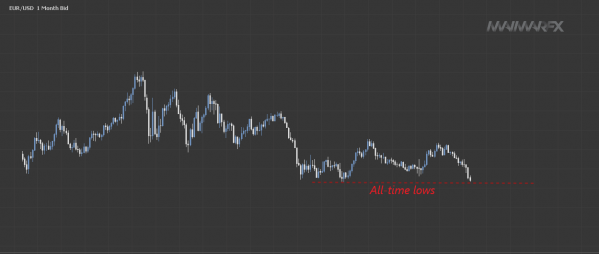

EUR/USD – How Low Can The Euro Go?

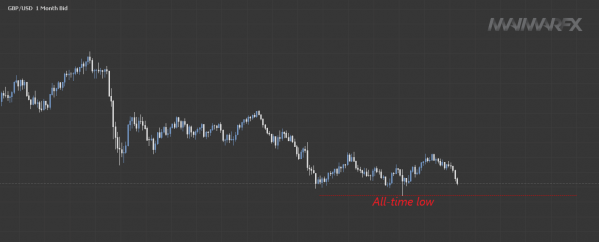

What a volatile roller coaster ride! The U.S. consumer price index came in at a shocking 9.1 percent and the U.S. dollar fluctuated sharply. After gains and losses, the greenback ended yesterday’s trading day virtually unchanged against the euro and British pound. The inflation-jump added fuel to bets that the Federal Reserve could raise rates by 100bp later this month.

EUR/USD – How low can the euro go?

Options traders have set a potential short-term bottom at 0.9850. However, the euro crisis is far from over which is why some warn a chaotic descent taking the euro even lower could be in the cards. Other strategists warn of a “non-linear” slide to 0.95.

For now, however, the pair is oversold, which is why we may see a modest rebound. In the short-term, we see the chances slightly in favor of the bulls with a rebound-target seen at around 1.0120.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

Daily Forex, DAX And Crypto Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: