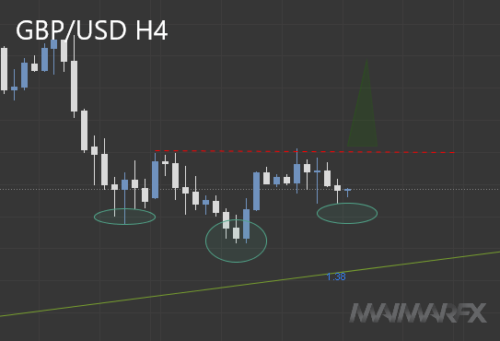

GBP/USD: Inverted SHS-Pattern To Predict Bullish Breakout?

Wednesday’s trading has proven challenging as our major currency pairs struggled to find a clear direction. GBP/USD rejected 1.40 but subsequent bearish momentum was not enough to send the pair below 1.3920 on the downside. EUR/USD tried an upside break of 1.21 before the U.S. dollar strengthened, pulling the pair lower towards 1.2040. The DAX was initially the best performer but the index refrained from ticking any higher than 14200 and consequently experienced a sharp reversal towards 13900.

What was the reason for yesterday’s direction change?

Bond yields surged again, dragging down shares on Wall Street. The U.S. dollar benefits from rising yields but yesterday’s dollar strength appeared to be limited. There is a risk that tomorrow’s Nonfarm payrolls report could disappoint dollar bulls, which is why the dollar’s appreciation ahead of the report could be limited. While the Fed has no intention to tighten its monetary policy anytime soon, the rise in bond yields reflects the market’s implicit way of tightening.

The EUR/USD was little changed and we recommend paying attention to price breakouts either above 1.2110 or below 1.1980.

GBP/USD – Inverted SHS formation to predict bullish breakout?

We currently see an inverted head-shoulder pattern in the 4-hour chart which could predict upcoming bullish momentum once the 1.40-level is successfully broken to the upside. A higher target could be at around 1.4170 after a potential breakout. The pattern becomes void if price breaks below 1.3850.

DAX: After another test of 14200 failed to provide a breakout, the index remains confined to a sideways trading range between 14200 and 13600.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: