After several weeks of lackluster momentum, market participants are now bracing for a heavy loaded week of event risk with not only three crucial Central Bank meetings on tap but also the U.S. nonfarm payrolls at the end of this week.

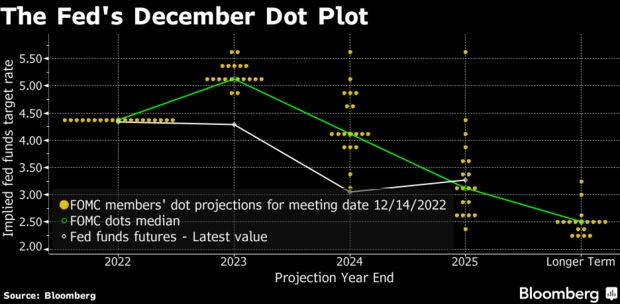

The first risk event will be Wednesday’s FOMC rate decision. The Federal Reserve is expected to slow the pace of tightening to 25 basis points. The problem is that the markets are ahead of themselves, appearing more dovish than the Fed. Rate cuts are already priced in looking two years out while inflation is still far above target. In other words, while the Fed may keep the focus on near-term tightening, the market is already speculating on an end of the tightening cycle instead of the possibility of keeping rates restrictive for some time. This sets the stage for disappointment rather than for confirmation of the speculation.

On Thursday, the Bank of England and European Central Bank rate decisions are due.

The BoE has hinted at yet another 50bp rate hike which is largely priced into GBP crosses. What could be bearish for the pound would be an additional vote split between 50bp and 25bp among BoE policy makers.

GBP/USD: The current bias is still bullish, provided the pair remains above 1.2250. A break below 1.2240 would possibly result in a quick sell-off towards 1.2170/1.21 and possibly even 1.20. On the top side, sterling bulls were still unable to push through the resistance zone at 1.2450 but this week’s fundamental drivers could provide a catalyst for a leg higher – or lower.

EUR/USD: The euro’s uptrend is still intact even though overbought conditions and the solid resistance around 1.09 raise the odds for a correction. If the ECB hints at a more aggressive approach in hiking rates to fight inflation while the Fed remains comfortable with slowing the pace of hikes, we could see a test of 1.10 and possibly even 1.11. On the downside, we keep tabs on the 1.0650-area as a potential support zone.

Daily Forex and DAX Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2023 MaiMarFX.

www.maimar.co

Follow us on social media:

Facebook

Twitter

Instagram