Inflation Will Be Key – Not Only For Fed But Also For The ECB

In the end, there were no dramatic price fluctuations Friday with U.S. jobs missing expectations. The payrolls report showed 559K jobs in May, a number that fell short of economists’ estimates while a half million new jobs is still a good growth number. The jobless rate fell to 5.8 percent while wage growth increased. As for the Federal Reserve policy stance, the shortfall in job growth, along with views that recent inflationary pressures will prove temporary, may help explain the Fed’s adhering to its ultra-loose policy.

The U.S. dollar depreciated against other peers in a first reaction to Friday’s report but the greenback’s drop was not sustained to push the euro or British pound above current resistance levels.

EUR/USD: As long as the pair trades between 1.2350 and 1.20 there is nothing new to report.

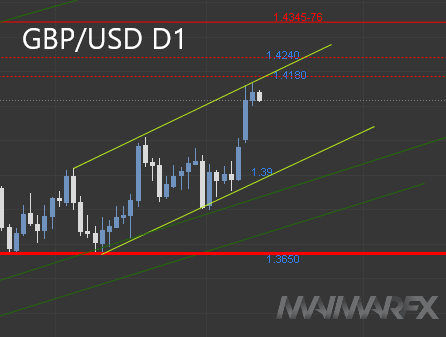

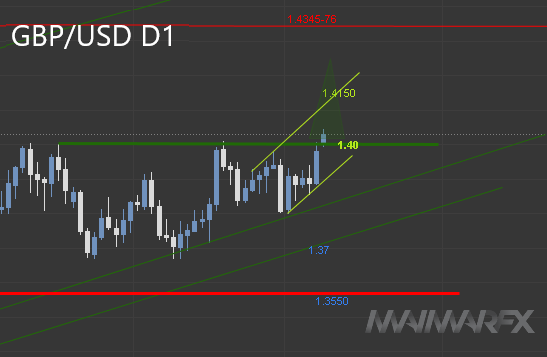

GBP/USD: Friday’s gains were capped at 1.42 and if sterling bulls are unable to push the pair above that barrier and further above 1.4270, the focus is on a break below 1.4070 but more importantly below 1.40.

While the slightly softer-than expected job gain probably won’t change the Fed’s thinking, another rise in inflation could spur the taper talk. The U.S. consumer price index is scheduled to be released on Thursday.

Also on Thursday, the European Central Bank will decide whether faster bond-buying will be extended until September to ensure the economic rebound. Economists expect the ECB to keep the pace of weekly bond buying unchanged through the summer before slowing down. However, this meeting could be tricky since the economic outlook is looking brighter, making it difficult for ECB policy makers to avoid a debate about a policy shift. While the short-term outlook is improving, the ECB may use a dovish rhetoric on medium-term inflation.

As for the ECB’s rhetoric, policy makers may stress that it is too early to withdraw any kind of stimulus with the taper debate returning to the fore after the summer.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: