ECB Decision: Will The Euro Extend Its Gains?

The dinner meeting between U.K. Prime Minister Boris Johnson and European Commission President Ursula von der Leyen ended without a breakthrough. The talks will continue until Sunday as both sides still want a deal.

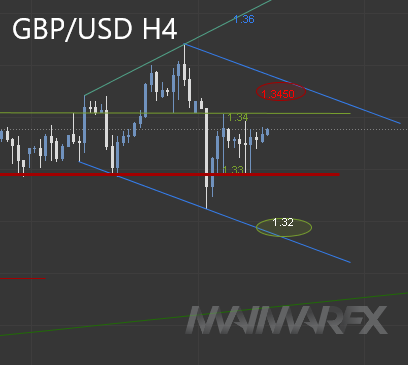

The pound gave up previous gains and dropped back below 1.34. Sterling’s price action followed a short-term downtrend channel (see our analysis from Wednesday), suggesting that upward movements could be limited to 1.3450 given that there is no Brexit breakthrough within the next two days.

Today all eyes will turn to the European Central Bank policy decision and the euro’s reaction to it. The ECB will publish its decision at 1:45 p.m. Frankfurt time and President Christine Lagarde will hold a virtual press conference 45 minutes later.

Policy makers are expected to add 500 billion euros to their emergency bond-buying program and extend it until at least the end of 2021. The deposit rate is expected to remain at -0.5%.

One risk is the current exchange rate of the euro which is making exports from the currency bloc less competitive and putting downward pressure on inflation by making imports cheaper. The ECB frequently stresses that it does not target the exchange rate but its commentary may try to restrain the euro.

The bottom line is that even if more easing is on the way which would normally weaken the currency, chances are in favor of a continuation of the euro’s rally.

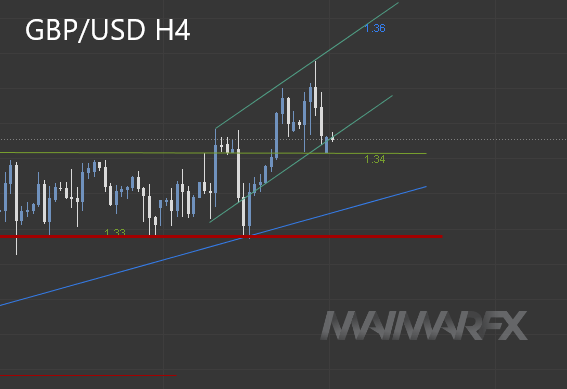

Recently, traders in the EUR/USD have taken a more cautious approach which can be seen in the euro’s consolidation phase following its peak at 1.2177 (see short-term downtrend channel in our analysis from Wednesday). However, the pause in the euro rally doesn’t necessarily mean that the bullish outlook has been negated.

Technically, the short-term downtrend channel (or bull flag if rally continues) now ranges from 1.2130 to 1.2040 and we will focus on breakouts above or below these levels.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2020 MaiMarFX.

Follow us on social media: