Welcome everyone to a new trading month.

The U.S. dollar dipped this morning after Friday’s appreciation and Treasury yields stabilized following last week’s rally. Traders will likely continue paying attention to the recent bond selloff and corresponding surge in yields. We bear in mind that if the bond selloff grows more aggressive, the risk sentiment deteriorates even further which is buoying the demand for the greenback.

Looking to the week ahead we will have the February U.S. employment report due on Friday. On Thursday, Fed Chair Jerome Powell is scheduled to discuss the economy at a Wall Street Journal event.

The greenback experienced its best week in about four months and this renewed strength could even continue in the days ahead. Meanwhile, the U.S. House of Representatives passed President Joe Biden’s $1.9 trillion Covid-relief package and investors begin to price in an unwinding of loose monetary policy in the long run. Friday’s latest non-farm payrolls report could come in with a better-than-expected result with the focus on average hourly earnings.

While the U.S. dollar’s fundamental forecast is bullish, we will keep tabs on the technical picture in the GBP/USD and EUR/USD.

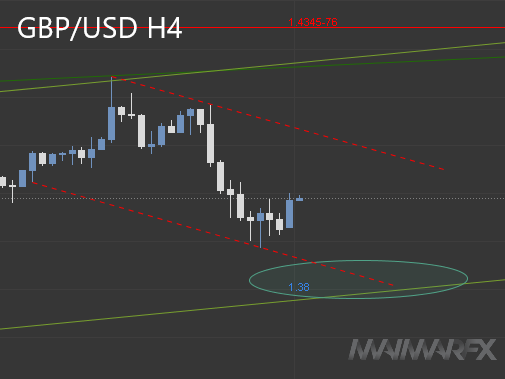

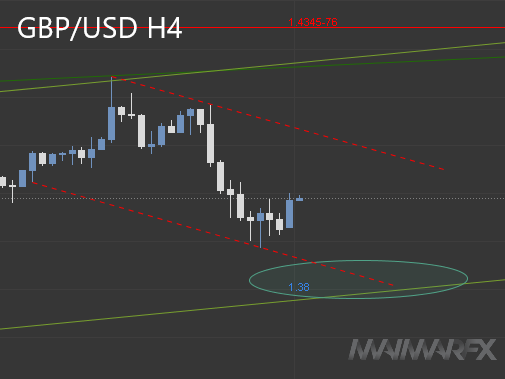

GBP/USD

The British pound experienced a long-needed correction after it rejected the 1.42-handle but bearish momentum ebbed after Friday’s dip below 1.39 proved short-lived. We now wait for another decline below 1.39 in order to mark lower targets at 1.3850 and 1.38. A lower resistance could now come in at 1.4120 and as long as the currency pair remains below 1.41 chances are in favor of the bears.

EUR/USD

The euro corrected its gains after a test of 1.2243 and it will be interesting whether sentiment could change in favor of the bears after a break below 1.2050. Lower targets are seen at 1.1960 and 1.19. Bulls in this pair should again wait for a break above 1.2185 but more importantly above 1.2230 in order to buy euros towards 1.23.

DAX

The index declined in tandem with the last week’s bond selloff but rebounded at the beginning of this week and is currently holding above 13800. As long as the DAX remains below the crucial price level of 14000, we will shift our focus to a lower target at 13600. A break above 14040 could however pave the way for a renewed test of 14150 and possibly even for a bullish breakout above 14200.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

www.maimar.co

Follow us on social media:

Facebook

Twitter

Instagram