More To Lose Than To Gain Amid Liquidity Drain

Dear Traders,

With many U.S. market participants being on holiday for a long weekend, there was not much consistency in the performance of the U.S. dollar and given the unsteady fluctuation there was more to lose than to gain. With liquidity running short we recommend traders not investing much or doing a trading break until market liquidity stabilizes next week.

The euro was little changed and refrained from trading any higher than 1.0585. On the downside, it marked a fresh low at 1.0518 which was much to the displeasure of short traders as our short entry was triggered and quickly stopped out. We expect the euro to trade between 1.0610 and 1.0540 today whereas a break above 1.0615 may drive the euro higher towards 1.0640 or even 1.0660. Below 1.0540 we see chances of accelerated bearish momentum towards 1.05 and 1.0480.

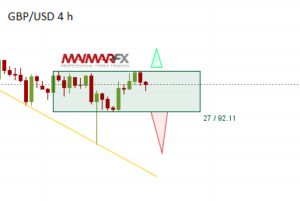

The trading range in the GBP/USD narrowed and breakouts are becoming more likely in the near-term. Sterling traders should keep an eye on the U.K. GDP report scheduled for release at 9:30 UTC. Any surprises may boost the price action in the cable.

As the US rests we do not expect big market movements but nonetheless the U.S. Advance Goods Trade Balance due at 13:30 UTC might be worth watching.

Have a beautiful and relaxing weekend.

Daily Forex signals:

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2016 Maimar-FX.