Fed December Rate Hike Has Been Almost Completely Priced In; Time For A Correction?

Dear Traders,

After the dust settled around the U.S. Presidential elections, market participants returned to business as usual while risk appetite has been boosted by the Trump reflation trade. The focus now shifts back to Federal Reserve rate hike in December, while there was some concern that a Trump victory would give the Fed reason to delay further tightening. Instead the U.S. dollar and U.S. yields are running higher amid speculation Trump’s plans to boost infrastructure spending will spur rate hikes as inflation and economic growth pick up. Fed rate hike odds are currently holding above 80 percent and economic data this week may further support the Fed’s hawkish bias.

Most attention will be paid to Tuesday’s economic calendar with Eurozone GDP data, U.K. Consumer Prices and U.S. Retail Sales due for release. On Thursday, U.S. Consumer Prices are worth watching followed by Janet Yellen’s testimony before the Joint Economic Committee. CPI figures should be strong enough to keep the Fed on track to hike rates next month while Yellen is expected to maintain her bias towards higher rates. Last but not least, ECB President Mario Draghi is scheduled to speak at the Euro Finance Week in Frankfurt on Friday. The European Central Bank is expected to hold its course while analysts focus on a small alteration in the size and scope of the QE program in December rather than a rate cut.

Overall, economic conditions for the Eurozone remain stable and euro traders should bear in mind that the recent dip in EUR/USD can be attributed to the dollar’s rate expectations. Thus, the appetite for USD will continue to dominate the price action for the time being.The currency pair tested the support area around 1.0770 and it will now be interesting whether this support proves to be strong enough to withstand the downward pressure. If the euro drops below 1.0770 we expect further losses towards 1.07 and 1.0630. Near-term resistances are seen at 1.0850 and 1.0950.

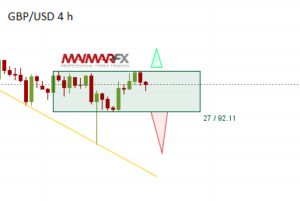

The GBP/USD dropped back below 1.26 but the decline came to a halt slightly above 1.25. If the pound is able to climb back above 1.26, we expect further gains towards 1.2720. Sterling bears should however focus on a break below 1.2440, reinvigorating fresh bearish momentum towards 1.2350 and 1.2270. U.K. CPI data on Tuesday will receive most attention but Wednesday’s U.K. Employment Report may also be worth watching.

We wish you a good start to the new week and many profitable trades.

Daily Forex signals:

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2016 Maimar-FX.