Wir sind aus unserem Urlaub zurück und wieder mit frischer Kraft am Trading Desk. Wir hoffen, dass die meisten von Ihnen sich bester Gesundheit erfreuen und ebenfalls fit und munter sind.

Der U.S. Dollar hat im August an Zugkraft gewonnen denn Investoren bevorzugten wieder vermehrt sichere Häfen inmitten steigender Risikoscheu durch Sorgen über Covid, die Reduzierung des Federal Reserve Stimulus und das Wirtschaftswachstum. Die Volatilität war in den letzten Tagen deutlich höher und Trader stellen sich auf Turbulenzen ein, sollten die Sorgen anhalten.

Marktakteure sind zudem auf der Hut im Vorfeld des Wirtschaftssymposiums in Jackson Hole am 26.-28. August. Das jährliche Event diente in der Vergangenheit oftmals als Umfeld wichtiger Verkündigungen. Trader sehen es als potenzielle Gelegenheit für Federal Reserve Präsident Jerome Powell den Zeitplan zur erwarteten Reduzierung der monatlichen Anleihekäufe (Taper) darzulegen. Es wird bei der Jahreskonferenz auf mehr Klarheit gehofft denn Trader wollen wissen, wann genau die monatlichen Ankäufe in Höhe von 120 Milliarden Dollar reduziert werden. Während die meisten Marktakteure von einem Taper bis Dezember 2021 ausgehen, so könnte die Dynamik im Dollar zunehmen, sollte es einen exakten Zeitplan geben. Das Gegenteil könnte hingegen der Fall sein, falls Powell während des Symposiums keine Vertiefung in den geldpolitischen Ausblick wagt. Die Enttäuschung könnte somit zum Abverkauf im Dollar führen. Wir könnten am Donnerstag mehr wissen.

Aus der technischen Sicht und nachdem der U.S. Dollar an Boden gewann gegenüber anderen Hauptwährungen, näherten sich sowohl der EUR/USD als auch der GBP/USD letzte Woche wichtigen Unterstützungszonen. Der Abverkauf hat allerdings zu Beginn dieser Woche etwas nachgelassen und der Euro und Cable scheinen aktuell zu einer kleinen Erholung bereit zu sein.

Beide Paare EUR/USD und GBP/USD befinden sich seit Mai 2021 in einem Abwärtstrend.

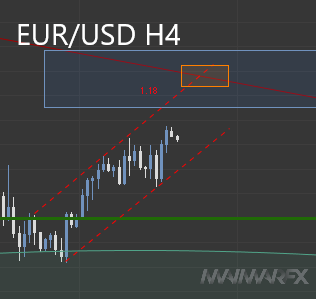

EUR/USD – 1.16 als Knackpunkt

Nachdem der Euro die 1.17-Marke durchbrach richteten Trader ihren Fokus auf die gewichtige 1.16-Unterstützung. Sollte diese deutlich gebrochen werden, könnten wir einen stärkeren Abverkauf erleben mit tieferen Zielen bei 1.14 und 1.10. Falls 1.16 hingegen standhält, rechnen wir mit Erholungen in Richtung von 1.18 und 1.19. Kurzfristig erwarten wir das Paar zwischen 1.1760 und 1.1640 handelnd.

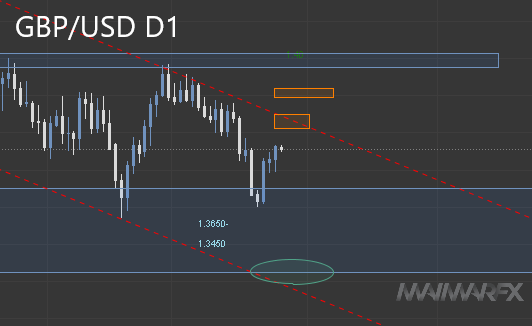

GBP/USD

Nachdem das 1.39-Level nicht zurückerobert werden konnte, ging es bergab Richtung 1.36 und damit betrat der Cable die Unterstützungszone welche sich von 1.3650 bis 1.34 erstreckt. Wir erwarten das Paar nun zwischen 1.3850 und 1.3450. Wir merken allerdings an, dass sich der Cable momentan im überverkauften Bereich befindet, was Erholungen wahrscheinlicher macht.

DAX

Der Index tendierte wieder aufwärts nachdem es letzte Woche bis fast 15600 runter ging. Ein Ausbruch über 15920 könnte zu einem erneuten Test von 16000 führen und eventuell sogar zu einer Ausdehnung bis 16100. Auf der Unterseite sehen wir aktuell eine wichtige Unterstützungszone um 15500 herum.

Wenn auch Sie wissen möchten, wo wir unseren Stopp-Loss und Take-Profit setzen und ob wir an einem bestimmten Tag handeln oder nicht, sowie wie wir unsere Positionen managen, dann abonnieren Sie unseren Signalservice.

Wir wünschen gute Trades!

Der Inhalt des Beitrags spiegelt die persönliche Meinung des Autors wider. Dieser übernimmt für die Richtigkeit und Vollständigkeit keine Verantwortung und schließt jegliche Regressansprüche aus. Dieser Beitrag stellt keine Kauf- oder Verkaufsempfehlung dar.

Copyright © 2021 MaiMarFX.

www.maimar.co

Folgen Sie uns über die sozialen Medien:

Facebook

Twitter

Instagram