Preparing For Potential Short Squeeze

Both EUR/USD and GBP/USD continue to tread water but traders are on the starting blocks, waiting for bigger movements by tomorrow.

While the U.S. dollar was relatively firm and could further strengthen if the Federal Reserve assures, they are ready to taper stimulus, we also prepare for a potential short squeeze in case of any disappointment.

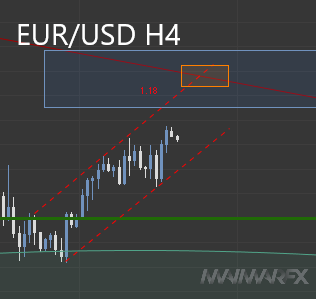

EUR/USD

The pair marked a short-term resistance at around 1.1775. Above 1.1780, we see a next target at 1.1815 (orange rectangle). Breaking above 1.1860 could see a test of 1.1890 and possibly even a run for 1.1940. Dollar bulls will wait for a renewed break below 1.1725 and more importantly 1.17 in order to push the pair lower towards the crucial 1.16-support.

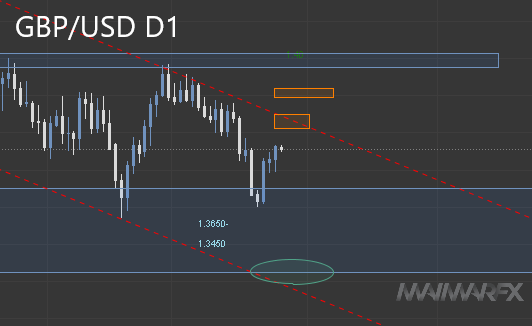

GBP/USD

The pair rebounded and as long as it holds stable above 1.3650-20, we pencil in higher targets at 1.3830 and 1.39 (orange rectangle resistance zones). An upside break of 1.3910 could spur bullish action towards 1.40. Breaking, however, below 1.36 could result in a sell-off towards 1.34.

Traders will watch the U.S. GDP report today at 12:30 UTC.

Daily Forex Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: