Dear Traders,

The ECB meeting is behind us but we had hoped for some larger market moves yesterday with a bit more follow-through after the euro’s technical break below 1.2150. The reason why the ECB statement turned out to be less market-moving this time is obvious: The central bank made absolutely zero changes to its policy statement in comparison with the March meeting, keeping to its commitment to bond-buying at a monthly 30 billion euros until at least September with interest rates on hold “well past” then.

ECB President Draghi talked primarily about their confidence in broad-based growth and that inflation will converge towards the ECB’s target over the medium term. He refrained from discussing monetary policy and the end of asset purchases.

In sum, despite Draghi’s upbeat tone the ECB statement revealed nothing fundamentally new. The next time the ECB releases a new set of Staff Economic Projections will be in June.

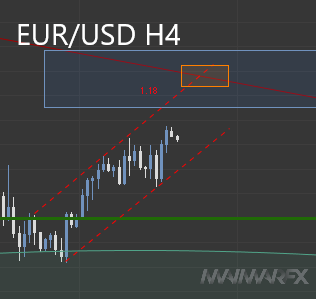

The euro dropped below 1.2150 but found a lower support at 1.2095 for the time being. The EUR/USD is still in deeply oversold territory, so traders should prepare for pullbacks. We expect a current resistance-zone to come in between 1.2160-80 but given the strong bearish bias the focus shifts to a next lower target around 1.2060/50.

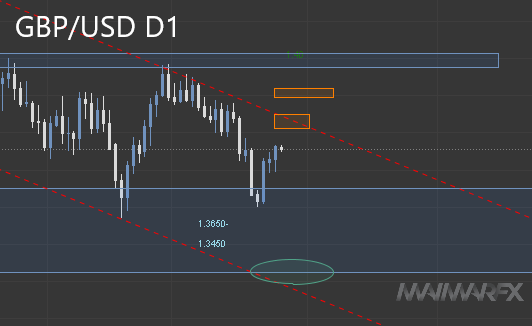

Yesterday’s trading in the GBP/USD was not to our liking as the pound traded choppily between 1.40 and 1.39. As for sterling bulls, the way is clear with buyers waiting for an upside break above 1.40. On the bottom side, however, sterling bears will have to wait for a break below 1.3875 in order to anticipate further losses.

We will watch the U.K. GDP numbers at 8:30 UTC which could have a major impact on the cable’s price action.

From the U.S. we have the Q1 GDP numbers scheduled for release at 12:30 UTC. The annualized growth rate is expected to register 2 percent down from 2.9 percent. If there is an upside surprise, the greenback could resume its rally and drive other major peers lower in return.

We wish you good trades for today and a nice weekend.

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2018 Maimar-FX.

www.maimar.co