Fasten Your Seatbelt For The Most Important (Volatile) Week Of The Year

Dear Traders,

This week is the most important week of the year with Thursday’s U.K. referendum paving the way for new trends in the market. The British pound jumped to a high of 1.4624 on eased concerns about the Brexit vote. The euro benefited from that optimistic tone and rose towards 1.14 on increased risk appetite.

The first poll taken after the murder of UK lawmaker Jo Cox showed the ‘Remain’ camp is gaining ground. The tragic death of pro-EU supporter Cox shifted some support back to ‘Remain’ and helped the pound and euro to recover from their lows. However, traders should be careful ahead of Thursday’s vote as volatility is likely to remain extremely high and large fluctuations in both directions are possible.

Ahead of the U.K. vote, Fed chair Janet Yellen testifies before Congress on Tuesday and Wednesday but no one expects her to reveal anything new about the guidance of future rate hikes. Policymakers are likely to wait for the outcome of the U.K. vote before setting the right course.

Traders should prepare for a volatile week in the Forex market and should bear in mind that anything can happen. We are curious to see how the market reacts and wish all traders many profitable trades.

EUR/USD

The euro rallied towards the upper bound of its recent downtrend channel. Once this barrier is significantly breached to the upside, the next important price level will be the crucial resistance zone at 1.14-1.1450. In search of attractive buying opportunities, the 1.1465- level may serve as a profitable long-entry. Above that level, the euro may head for a test of 1.15. Above 1.1530 it could even rally towards 1.1750. For the time being, we see a current support around the 1.13-level. Below 1.1230 the euro could drop back to 1.1130.

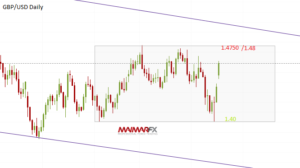

GBP/USD

Looking at larger time frames, the pound sterling is still trading within its range between 1.4750 and 1.40. We expect high-volatile swings ahead of Thursday’s referendum but as long as the currency pair remains confined to that range, there is no new trend. Let’s wait and see.

Daily Forex signals:

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2016 Maimar-FX.