Willkommen allerseits zurück nach einem langen Wochenende.

Die U.S. Arbeitsmarktdaten, welche am Karfreitag veröffentlicht wurden, übertrafen alle Markterwartungen und zeigten mit 916K Stellen das stärkste Jobwachstum in sieben Monaten. Jedoch überraschte das durchschnittliche Lohnwachstum nicht positiv und aufgrund der niedrigen Volatilität zu den Osterfeiertagen gab es somit auch keine großen Bewegungen.

Die rapide Erholung des U.S. Arbeitsmarktes könnte mittelfristig zu einem stärkeren U.S. Dollar führen denn Marktakteure schwenken ihren Fokus langsam in Richtung einer Wende in der Zinssatz Entwicklung der Federal Reserve. Investoren werden zudem die Auswirkungen der, von der Biden Regierung, geplanten Unternehmenssteuererhöhung beurteilen. Einige Wirtschaftler fürchten, dass höhere Steuern die Konjunkturerholung dämpfen werden.

Beide unserer Hauptwährungspaare starteten die neue Woche mit freundlicher Tendenz und weitere Bullendynamik könnte eventuell bevorstehen. Werfen wir einen Blick auf das technische Bild:

GBP/USD

Das Britische Pfund wartete im ersten Quartal generell mit Stärke auf gegenüber anderen Gegenspielern denn der Markt preist eine schnellere Rückkehr zur Normalität ein vor dem Hintergrund der erfolgreichen Impfkampagne im Vereinigten Königreich. Die U.K. Regierung geht in die nächste Phase ihres vier-Stufen Plans zur Wiedereröffnung der Wirtschaft und eben dieser Optimismus könnte das Pfund in den nächsten Wochen höher treiben. Solange das Paar oberhalb von 1.38 und 1.3750 verbleibt, rechnen wir mit steigender Tendenz und einem potentiellen Test von 1.40 – dem wichtigen Widerstandslevel. Sollte 1.40 nach oben gebrochen werden, so befänden sich höhere Ziele bei 1.42 und 1.4450.

EUR/USD

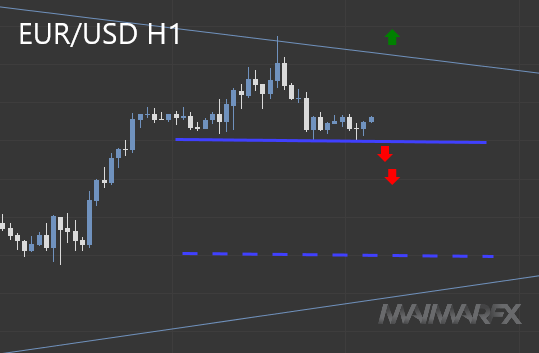

Die schwindende U.S. Dollarstärke hat dem Währungspaar geholfen sich nahe 1.18 zu stabilisieren. Während sich die Eurozone weiterhin mit Herausforderungen konfrontiert sieht, so besteht auch weiterhin Druck auf den Euro. Dennoch werden wir unseren Blick auf die Widerstandszone zwischen 1.1950 und 1.20 richten, welche eine profitable Verkaufsgelegenheit bieten könnte. Oberhalb von 1.2015 könnte hingegen das höhere 1.2150-Widerstandslevel getestet werden. Auf der Unterseite sehen wir eine kurzfristige Unterstützung bei 1.1670, gefolgt von dem gewichtigen Support bei 1.16. Sollte 1.16 zur Unterseite brechen, so sehen wir ein tieferes Ziel bei 1.12.

DAX

Der Index kennt nur ein Richtung- aufwärts. Während wir bereits ein nächstes höheres Ziel bei 15750 einzeichnen, bereiten wir uns auch auf eine Korrektur vor. Das 15000-Level könnte jetzt als eine Unterstützung dienen, doch sollte diese brechen, könnte es zu einer tieferen Korrektur bis 14800 und eventuell 14400 kommen.

Diese Woche steht am Mittwoch das FOMC Protokoll an, jedoch gehen wir hierbei nicht von einem Auslöser für große Marktbewegungen aus. Am Donnerstag wird Federal Reserve Präsident Jerome Powell an einer Diskussion zur globalen Weltwirtschaft teilnehmen.

Wir wünschen gute Trades!

Der Inhalt des Beitrags spiegelt die persönliche Meinung des Autors wider. Dieser übernimmt für die Richtigkeit und Vollständigkeit keine Verantwortung und schließt jegliche Regressansprüche aus. Dieser Beitrag stellt keine Kauf- oder Verkaufsempfehlung dar.

Copyright © 2021 MaiMarFX.

www.maimar.co

Folgen Sie uns über die sozialen Medien:

Facebook

Twitter

Instagram