Focus On Powell Speech

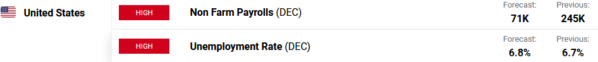

Federal Reserve chair Jerome Powell will give a speech today at 18:30 UTC at the Brookings Institute. His speech with the title Economic Outlook, Inflation, and the Labor Market comes just before the release of the latest U.S. inflation and jobs data. Powell is expected to confirm expectations the Fed will slow its pace of rate hikes next month, even though the fight against inflation is not over yet. If Powell, however, states that interest rates will need to remain elevated for longer to counter high inflation, the U.S. dollar will push higher again.

Our trading ideas for today 30/11/22:

EUR/USD

Long @ 1.0380

Short @ 1.0310

GBP/USD

Long @ 1.1990

Short @ 1.1930

DAX® (GER40)

Long @ 14440

Short @ 14390

Settings for all trades today: Entries from 8:00 am UTC, SL 25

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: