Markets Were Slightly Rattled By Europe Turmoil

Dear Traders,

Shortly before Christmas the mood changed from pleasure to shock and grief following Monday’s multiple terrorist attacks such as the Christmas market tragedy in Berlin, which was probably a terror attack, a shooting near the Islamic center in Zurich and the assassination of Russia’s ambassador to Turkey. The killing of Russia’s ambassador Andrey Karlov and the deadly truck attack at a Berlin Christmas market, killing 12 people added to geopolitical uncertainty and caused financial market turmoil on Monday.

Meanwhile, the U.S. dollar received a boost from Federal Reserve Chair Janet Yellen as she expressed in her speech at the University of Baltimore her optimism about the developments in the current U.S. labor market. She said that the job market is the strongest in nearly a decade and that it contributes to higher wages. All in all, dollar bulls had every reason to buy the dollar on dips, which is why a potential pullback still appears to be some way off.

EUR/USD

Double bottom or short-term support?

The euro tagged a fresh low at 1.0366 and once this level is breached to the downside, we could see the euro tumbling towards 1.03 and 1.0250. On the other hand, if the euro is able to hold above the 1.0365-level we will shift our focus to the 1.0480-mark which is seen as a current resistance in this pair. Above 1.0480 the double-bottom pattern will be played out, suggesting that the euro is headed for higher prices at 1.0530 and 1.0560.

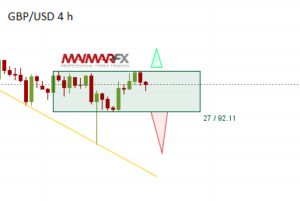

GBP/USD

The descending triangle points to further losses. As mentioned in previous analysis we see a current support area between 1.2350 and 1.23. Furthermore, a descending trend line at 1.2340 marks the lower bound of the current trend channel so if the pound falls below 1.2340 and further 1.23, we expect accelerated bearish momentum sending the pound lower towards 1.2130.

There are no major economic reports scheduled for release today so the price development could be subdued.

Daily Forex signals:

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2016 Maimar-FX.