Der U.S. Dollar ist mit weiteren Verlusten in die neue Woche gestartet nachdem die U.S. Arbeitsmarktdaten vom letzten Freitag weit unter den zuvor sehr hohen Markterwartungen lagen. Der Stellenzuwachs lag bei lediglich 266.000 neuen Jobs im April, wobei im Vorfeld von einer Million ausgegangen worden war. Was wir am Freitag sahen war ein starker Abverkauf im Dollar, wobei die schwachen Job Daten vermuten lassen, dass die Federal Reserve ihre expansive Geldpolitik noch für eine Weile beibehalten wird.

GBP/USD

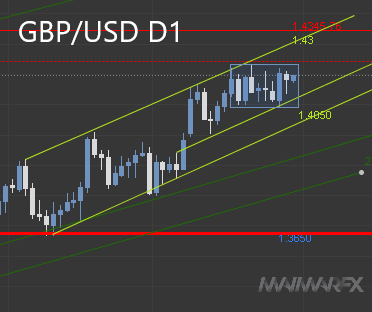

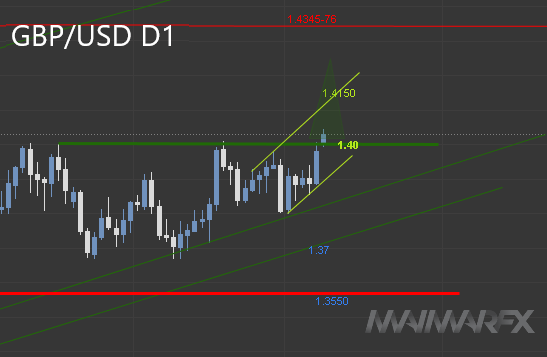

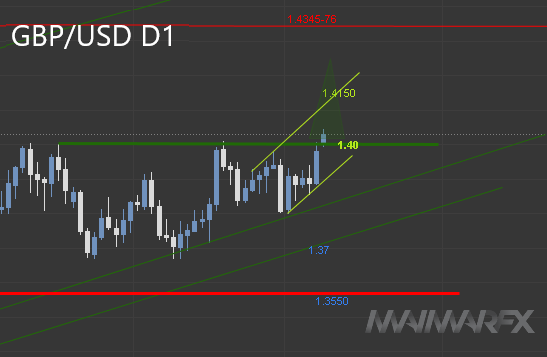

Der beste Performer war das Britische Pfund, welches die wichtige Widerstandsbarriere bei 1.40 überwand aufgrund eines schwächelnden U.S. Dollars auf der einen und des Beginns der geldpolitischen Straffung seitens der Bank von England auf der anderen Seite. Aus fundamentalanalytischer Sicht ist der wirtschaftliche Ausblick im Vereinigten Königreich weiterhin positiv einzustufen denn das Land beendet seine Lockdowns während über die Hälfte der Bevölkerung bereits immunisiert ist. Was das Schottische Unabhängigkeitsreferendum anbetrifft, so verfehlte Nicola Sturgeons SNP Partei in der Wahl von letzter Woche mit einem Sitz die absolute Mehrheit, was Sterling Investoren etwas aufatmen ließ. Während ein Unabhängigkeitsreferendum damit nicht vom Tisch ist, so scheint die unmittelbare Gefahr für das Pfund vorerst gebannt.

Technisch gesehen ist der kurzfristige Ausblick bullisch – vorausgesetzt der Cable hält sich oberhalb von 1.39. Wir sehen ein nächstes höheres Ziel bei 1.4150. Damit jedoch die Bullendynamik anhält, müsste sich das Pfund oberhalb von 1.40 stabilisieren. Bricht hingegen auf der Unterseite 1.3920, könnten sich die Chancen zugunsten der Bären wenden.

EUR/USD

Der Euro stabilisierte sich oberhalb von 1.2130 und könnte sich nun auf dem Weg in Richtung von 1.2250 befinden. Solange das Paar oberhalb von 1.2040 verbleibt, bevorzugen wir den Aufwärtstrend.

DAX

Der Index tendierte aufwärts während jetzt langsam wieder die 15500-Marke in den Fokus rückt. Wir werden auf einen Bruch des April-Hochs bei 15518 warten um das Augenmerk in Richtung höherer Ziele jenseits von 16000 zu schwenken. Eine aktuelle Unterstützung könnte sich bei 15300 befinden.

Am Mittwoch stehen die U.S. Inflationsdaten an und könnten von besonderem Interesse sein, denn eine Steigung im Monat April könnte vermehrt Druck auf die Fed ausüben, über eine geldpolitische Straffung eher früher als später nachzudenken. Am gleichen Tag wird Bank von England Gouverneur Andrew Bailey auf die Geldpolitik eingehen, was einen Einfluss auf das Pfund haben könnte.

Wir wünschen gute Trades!

Der Inhalt des Beitrags spiegelt die persönliche Meinung des Autors wider. Dieser übernimmt für die Richtigkeit und Vollständigkeit keine Verantwortung und schließt jegliche Regressansprüche aus. Dieser Beitrag stellt keine Kauf- oder Verkaufsempfehlung dar.

Copyright © 2021 MaiMarFX.

www.maimar.co

Folgen Sie uns über die sozialen Medien:

Facebook

Twitter

Instagram