Welcome back at the desks after a long weekend.

Nonfarm payrolls data released on Good Friday smashed all market expectations and came in at 916k which was the strongest job gain in seven months. However, average hourly earnings did not surprise to the upside and given the low volatility environment during the Easter holiday, there were no major market movements.

The rapid healing of the U.S. labor market could lead to a stronger U.S. dollar in medium-term time frames as market participants will slowly shift their focus towards a change in the Fed’s future interest rate path. Investors will also assess the impact of the Biden administration’s proposed increase to the corporate tax rate, fearing that higher taxes will hinder the economic recovery.

Both EUR/USD and GBP/USD started the new week on a positive note and further bullish momentum could be ahead. Let’s take a look at the technical picture:

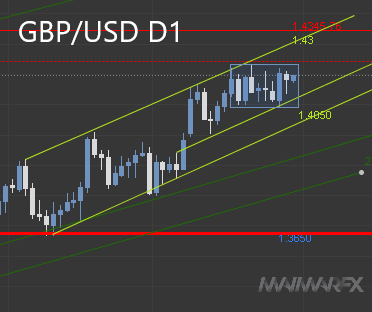

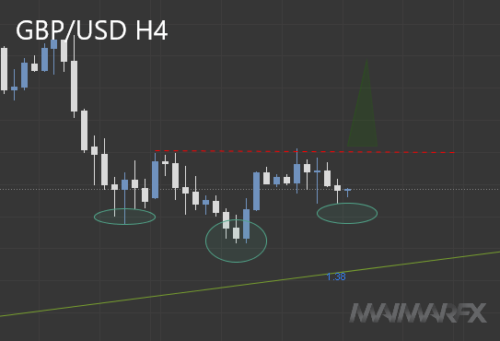

GBP/USD

The British pound has generally strengthened against its counterparts in the first quarter as the market prices in a faster return to normality on the back of the U.K.’s successful vaccine rollout. With the U.K. government moving to the next stage of its four-stage reopening plan, optimism could drive the pound higher. As long as the currency pair holds above 1.38 and 1.3750, we anticipate an uptick with a potential test of 1.40 – a crucial resistance level. If 1.40 breaks to the upside, higher targets are seen at 1.42 and 1.4450.

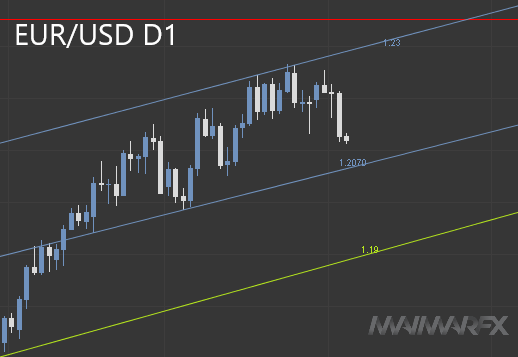

EUR/USD

Fading U.S. Dollar strength has helped the currency pair to stabilize around 1.18. While the Eurozone continues to face challenges, the euro is likely to remain under pressure. Nonetheless, we will turn our focus to the resistance area between 1.1950 and 1.20 which could provide a profitable opportunity to sell euros at higher levels. Above 1.2015, the euro could even test 1.2150. On the downside we see a short-term support at 1.1670 followed by a crucial support at 1.16. If 1.16 breaks to the downside a next lower target is seen at 1.12.

DAX

The index knows only direction – upwards. While we pencil in a next higher target at 15750, we also brace for a correction. The 15000 level could now serve as a support but if it breaks, we could see a deeper correction towards 14800 and possibly even 14400.

This week we will have the FOMC meeting minutes on Wednesday but we don’t expect the minutes to serve as a catalyst for big market movements. On Thursday Federal Reserve Chairman Jerome Powell takes part in a panel about the global economy.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

www.maimar.co

Follow us on social media:

Facebook

Twitter

Instagram