The British pound and euro reversed sharply higher last Friday after U.S. jobs data saw only 150k created in October, missing the market’s expectations of 180k. Furthermore, U.S. Treasury yield sell-off accelerated after Friday’s NFP report, which in turn weakened the U.S. dollar. There is a growing feeling that interest rates in the U.S. have peaked and that a potential recession in the next months could make rate cuts necessary.

GBP/USD

Technically, we got the price breakout we have been looking for. Sterling surged until almost 1.24 on Friday. The EMA200 oscillates at 1.2410 and if sterling bulls will want to turn the tide from bearish to bullish, they will need to stabilize sterling above 1.24. Watch out for a rise above 1.2415 now. A fresh support could now lie at around 1.2150.

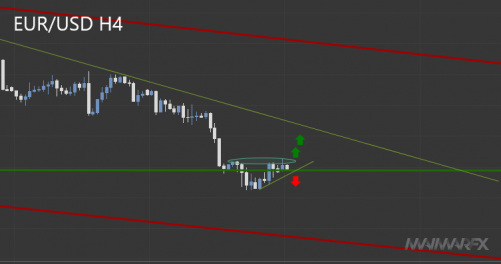

EUR/USD

The euro hit 1.0746 after the 1.05-support has proved to hold. If the bullish bias continues, we will keep tabs on a break above 1.0760 in order to pencil in a higher target at around 1.0940.

DAX

The index was on the rise again and stabilized above the 15000-mark. We now see a next higher target at 15460 from where we may see stronger pullbacks. On the downside, the 15000-threshold, however, remains a crucial barrier.

This trading week will be a quieter week for traders in terms of market-moving event risks.

We will not invest too much at the start of this week.

Daily Forex and DAX Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2023 MaiMarFX.

www.maimar.co

Follow us on social media:

Facebook

Twitter