U.S. Job Bericht: Vorsicht- Verbrennungsgefahr!

Wie erwartet kam es am Donnerstag zu größeren Bewegungen denn Marktakteure positionierten sich für einen stärkeren U.S. Arbeitsmarktbericht nachdem die ADP Beschäftigungsänderung deutlich positiv überraschte. Short Trader kamen sowohl im EUR/USD als auch im GBP/USD auf ihre Kosten und heute wartet jeder gespannt darauf, ob der Job Bericht den Straffungs-Talk bei der Federal Reserve einläuten wird. Sollte der Bericht die Erwartungen übertreffen, so wird der U.S. Dollar steigen denn es herrscht mehr Druck auf der Fed, eher früher als später einen falkenhaften Schritt zu unternehmen.

Wie dem auch sei, die Erwartungen sind heute extrem hoch und Trader sollten vorsichtig sein denn es muss mit extremen Kurs Fluktuationen zur Veröffentlichung der Daten um 14:30 Uhr gerechnet werden. Extreme Volatilität kann vorige Gewinne blitzschnell ausradieren und zu starken Verlusten führen. Die Einschätzungen zum Jobwachstum rangieren von 335,000 bis zu 1 Million neuer Stellen im Mai, somit ist alles möglich und macht es extrem gefährlich im Vorfeld der Daten eine Position einzugehen. Worauf zudem genau geachtet werden sollte ist das Lohnwachstum. Der Greenback wird von einer höheren Lesung profieren während Spekulationen über einer Straffung an Dynamik gewinnen.

Während alles vom NFP Ergebnis abhängen wird, werfen wir jedoch noch einen kurzen Blick auf das technische Bild zur besseren Orientierung.

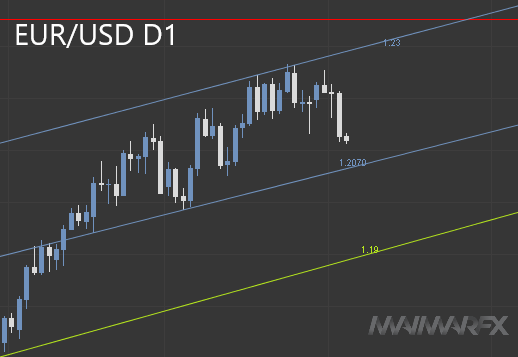

EUR/USD

Der übergeordnete Trend ist aufwärts mit wichtigen Unterstützungszonen bei 1.20, 1.19 und 1.16. Auf kurzfristigen Zeitebenen, fällt der Euro unter 1.2070, erwarten wir weitere Verluste in Richtung von 1.19. Auf der Oberseite bräuchten Bullen einen signifikanten Ausbruch oberhalb von 1.23 und ferner 1.2350 um den Fokus gen 1.25 zu richten.

GBP/USD

Solange sich der Cable oberhalb von 1.4050 aufhält, wird der jüngste Aufwärtstrend als intakt angesehen. Eine wichtige Unterstützungszone erstreckt sich danach von 1.40 bis 1.3950 und sollte diese Zone nach unten durchbrochen werden, könnten wir eine tiefere Korrektur bis 1.38 und 1.37 sehen. Auf der Oberseite, werden Bullen das 1.4250-Level erklimmen müssen um das Pfund Richtung 1.4350 zu pushen.

Wenn auch Sie wissen möchten, wo wir unseren Stopp-Loss und Take-Profit setzen und ob wir an einem bestimmten Tag handeln oder nicht, sowie wie wir unsere Positionen managen, dann abonnieren Sie unseren Signalservice.

- Hier können Sie unseren Signal Service abonnieren

Wir wünschen gute Trades!

Der Inhalt des Beitrags spiegelt die persönliche Meinung des Autors wider. Dieser übernimmt für die Richtigkeit und Vollständigkeit keine Verantwortung und schließt jegliche Regressansprüche aus. Dieser Beitrag stellt keine Kauf- oder Verkaufsempfehlung dar.

Copyright © 2021 MaiMarFX.

Folgen Sie uns über die sozialen Medien: