EUR/USD And GBP/USD: Further Bearish Momentum Ahead?

Welcome to a new trading week.

Rising yields in the U.S. continued to support the greenback as it outperformed the euro and British pound.

The pound came under additional selling pressure as the vaccine conflict between the EU and the U.K. has been growing since AstraZeneca informed Brussels it wouldn’t deliver the number of vaccine shots it had promised for the first quarter. The EU is ready to block exports of the AstraZeneca Plc vaccine to the U.K. until the company fulfills its delivery obligations to the bloc.

EU leaders will meet in Brussels on Thursday and Friday to discuss the vaccine restriction plan among other topics.

While the EU looks to be struggling to vaccinate its population against Covid-19 the fundamental forecast for the euro is bearish.

EUR/USD

Looking at the technical picture we pencil in a lower target at around 1.18 and it will be interesting for euro bears whether a significant break below that crucial support level will lead to a slide towards 1.16. On the upper side, the recent resistance at 1.20 remains a focus of interest and we will wait for a bullish break above that level and further 1.2060 in order to expect higher targets at 1.2170 or 1.2250.

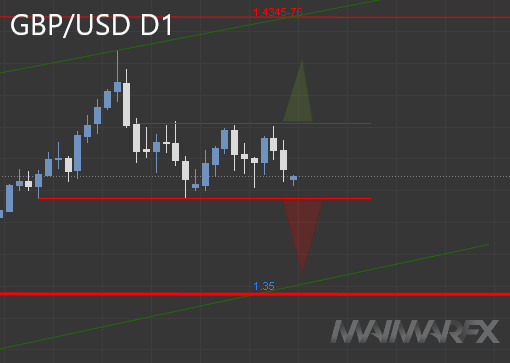

GBP/USD

The cable remained within in its recent sideways range as both the Federal Reserve and the Bank of England retain their current course for monetary policy. While the current vaccine battle between the U.K. and EU weighs on the exchange rate, the fundamental forecast for the pound remains neutral.

Technically, we continue to watch out for price breaks either above 1.40 or below 1.3780.

On the economic docket this week we will have central bankers’ speeches at the BIS Innovation Summit, U.K. CPI figures on Wednesday and the EU summit in Brussels.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: