Dear Traders,

We hope you successfully weathered the first day of Yellen’s testimony and the currencies’ whipsaw performance.

The Federal Reserve Chair sounded slightly more cautious on the inflation outlook while saying the U.S. economy should continue to expand over the next few years, allowing the central bank to stick to its path of higher interest rates. In the Q&A session, Yellen indicated the Fed is still considering risks around the inflation outlook while inflation is running below the Fed’s 2 percent target. Concerning the Fed’s balance sheet, Yellen mentioned that the central bank anticipates it will start reducing its balance sheet “this year” while the size of the balance sheet is uncertain.

The Fed chair will continue testifying today at 14:00 UTC before the Senate Banking Committee.

In short, Yellen’s comments suggest that the Fed is in no rush to tighten monetary policy because of too-low inflation, even though the U.S. economy is in good shape. This slightly less hawkish tone bodes well for U.S. stocks but weakens the U.S. dollar.

Traders of the EUR/USD now might argue that the U.S. dollar strengthened instead in the aftermath of the testimony. One reason for the euro’s short-term decline might be speculation the ECB could follow the Fed’s low inflation expectations and may put the awaited taper in question, at least in the near future.

For our part, we expect the EUR/USD to strengthen, heading for a test of 1.15. Euro bears should however wait for a break below 1.1380 or, on the other hand, sell euros at higher levels following a test of 1.15.

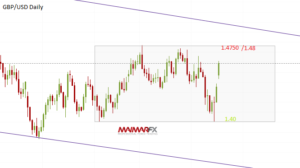

As expected, the GBP/USD received a boost from stronger-than-expected U.K. labor market data and started its relief rally towards 1.29. If the pound breaks above 1.2930 we expect further gains towards 1.2970 and possibly even 1.3020. A significant break below 1.2850 however, could spark bearish momentum towards 1.28.

If you want to know how to exactly trade EUR/USD and GBP/USD including an appropriate money management per trade and day, sign up for our daily signal service here.

Daily Forex signals:

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2017 Maimar-FX.

www.maimar.co