U.S. Dollar Regains Strength, Focus On GDP Data

Dear Traders,

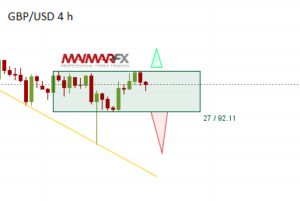

The U.S. dollar regained some strength Thursday, leading to downturns in the euro and cable. The pound currently faces its support at 1.2550 and sterling bears may wait for breakouts below 1.2530 and 1.2490 to sell sterling towards 1.2450/1.24. For the pound to rally, it may need to climb through the 1.2610-level again.

The euro dropped significantly below 1.07 and our guess of upcoming bearish momentum following a head-shoulders pattern (stated in Wednesday’s analysis) was finally right. Now the euro will need to break below 1.0650 so that we can focus on lower targets at 1.0620 and 1.0590. Below 1.0580 however, bearish momentum could accelerate towards 1.05. Those who are looking for any further upside momentum should rather wait for prices above 1.0720 in order to buy euros. Above 1.0770 a higher target could be at 1.0815.

Today, all eyes will be on important U.S. data such as GDP figures and Durable Goods Orders, both reports are scheduled for release at 13:30 UTC. Fourth-quarter GDP numbers are forecast to show slower growth and if that forecast proves to be correct, we may see further weakness in the greenback.

We wish you good trades for today and a relaxing weekend.

Daily Forex signals:

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts https://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service https://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2017 Maimar-FX.