More USD Gains Ahead?

Welcome everyone to a new trading week!

This week started with some corrective movements in the market as investors evaluate stretched valuations while becoming more cautious on global shares at recent high levels. The U.S. dollar rose against its major peers and higher yields could buoy the demand for the greenback.

Friday’s nonfarm payrolls report disappointed, showing the economy shed 140,000 jobs in December instead of adding 71,000 as expected but it was the unexpectedly spike in wage growth to a seven-month high of 5.1 percent on-year which has helped the dollar gaining some ground in the aftermath of the report.

Traders anticipate that incoming fiscal stimulus will underpin employment, which is why the market could shift away from dovish extremes on Federal Reserve policy expectations.

President-elect Biden pledged to lay out plans for another fiscal stimulus boost on Thursday.

While the longer-term outlook for the dollar remains bearish, we could see more USD gains in the near-term.

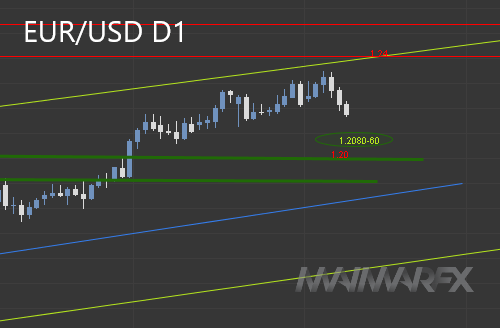

The pair bounced of the 1.2350-barrier and could now be heading towards a designated support zone around 1.2080-60, from where buyers could swoop in. A break below 1.2050, however, would shift the focus toward a crucial support at 1.20. On the upside, we will keep an eye on a break above 1.2275 which could prompt bulls for a test of 1.24.

GBP/USD

The cable formatted a recent downtrend channel with a lower support zone seen between 1.3460 and 1.34. Bulls may attempt to push the pound higher when hitting the 1.3450-mark but if the pair drops below 1.34, we may see further losses towards 1.3330. A current resistance is, however, seen at 1.36.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2021 MaiMarFX.

Follow us on social media: