Euro: The Longest Losing Streak Since 1997

The euro confirmed a 9th consecutive weekly loss, the longest losing streak since 1997.

The common currency dropped like a stone towards 1.0630 after the European Central Bank raised interest rates last Thursday but there were signs that rates had peaked. Recession risk and worsening sentiment indicators in Germany fuel arguments against further hikes.

Looking at the weekly chart we see, that despite the euro’s steep fall, it remains still above the crucial support area around 1.05. Given the recent bearish strength we could imagine that the pair tests the 1.06-level before a pullback towards 1.08 is in the cards. However, the U.S. dollar will play a major role this week, so traders will likely wait for the Fed decision before deciding which way to go.

EUR/USD

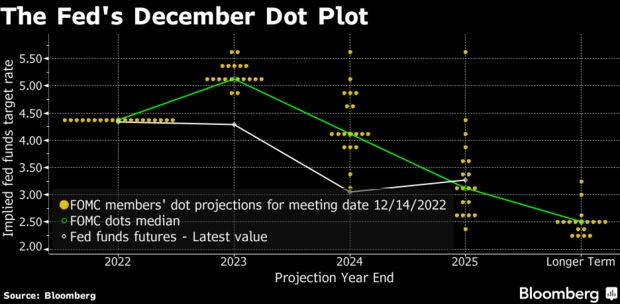

This week is again loaded with event risk, including multiple central bank decisions. We will focus on the Federal Reserve rate decision Wednesday and while the Fed is widely expected to leave rates unchanged this month, traders access the prospects of a further hike by the end of this year.

The Bank of England is expected to deliver a 25bp rate hike on Thursday. In case of a dovish hike or more precisely, if the BoE give a hint that rates are near their peak, the pound sterling will fall.

Daily Forex and DAX Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2023 MaiMarFX.

Follow us on social media: