Quiet Week Before The Easter Holidays?

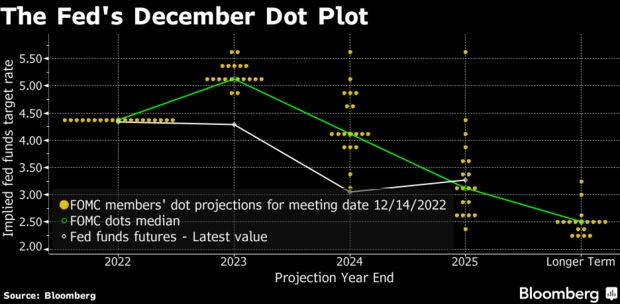

After markets had a few days to digest last week’s dovish FOMC meeting, where the Federal Reserve continued to signal three rate cuts in 2024, even though fresh forecasts pointed to slightly hotter inflation. The message behind last week’s decision is that the Fed seems willing to let inflation run hot for longer, to minimize the risk of a recession.

However, the U.S. dollar’s counterparts encountered their own problems and gave up their lofty gains while the greenback managed to recover previous losses. The pound fell sharply after the Bank of England softly opened the door for a summer rate cut.

GBP/USD

The pound crushed into reality and below 1.26 after it was flirting with the lofty 1.29-barrier. It will now be interesting whether daily candles close below 1.26 (blue EMA), since this would point to a fresh downtrend. Given that this week will be accompanied by low volatility, we expect that the pair will trade in tight ranges. A next resistance comes in at around 1.2650, followed by 1.2720. However, bearish candles suggest more downside momentum to come.

EUR/USD

The euro remains within its sideways trading range but recently tilts to the downside. Remaining below 1.0850 would turn the focus to the lower 1.07-target.

DAX – Is everything right with the high-flyer?

With a chart like this, we can only express our doubts that this steep uptrend will continue. What do you think?

This week will be quiet in terms of market-moving data. The only interesting piece of data will be the PCE price index, due for release on Friday. Friday, however, will be a public holiday, so liquidity is expected to be thin.

Daily Forex and DAX Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2024 MaiMarFX.