Bullish Outcome For the U.S. Dollar Post CPI

What a trading day!

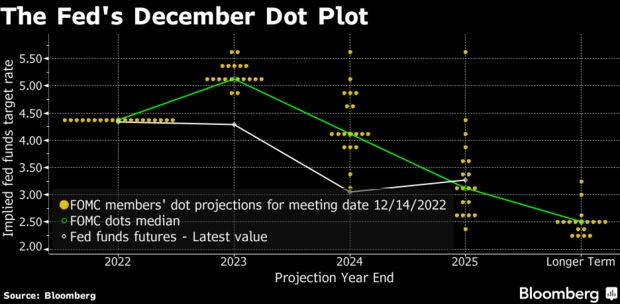

The hotter-than-expected U.S. inflation numbers sent the U.S. dollar soaring and all of our yesterday’s short entries in both EUR/USD and GBP/USD have proved highly profitable. The still high inflation diminished hopes for a Federal Reserve June rate cut, an expectation that was unthinkable at the start of this year, when the consensus view was for six cuts, beginning already in March! This repricing sent Treasury yields and consequently the greenback soaring.

The EUR/USD crushed again below 1.0830 but found some halt at the 1.0720-support area. Falling below 1.0720 will turn the focus to a potential break of 1.07 and possible a dip towards 1.0650. Euro bulls will take a backseat until a renewed break above 1.0880.

The GBP/USD fell towards its 2024-low at 1.2518 and traders are curious whether the support around 1.25 could now break.

Today, the European Central Bank is set to decide on its monetary policy guidance but the ECB is largely expected to point towards the start of rate cuts in June. Traders do not expect today’s announcement to be a huge market mover since the rate cut timeline has already communicated by ECB officials. However, the press conference at 12:45 GMT may increase volatility across the euro currency pairs.

Let’s wait and see.

Daily Forex and DAX Signals:

If you are keen to know where we put Take-Profit and Stop-Loss, if we trade on a specific day or not and how we manage open positions, subscribe to our signals.

Our trading ideas for today 11/4/24:

EUR/USD

Long @ 1.0785

Short @ 1.0720

Settings for all trades today: Entries from 8:00 am UTC, SL 25, TP 20-30

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2024 MaiMarFX.