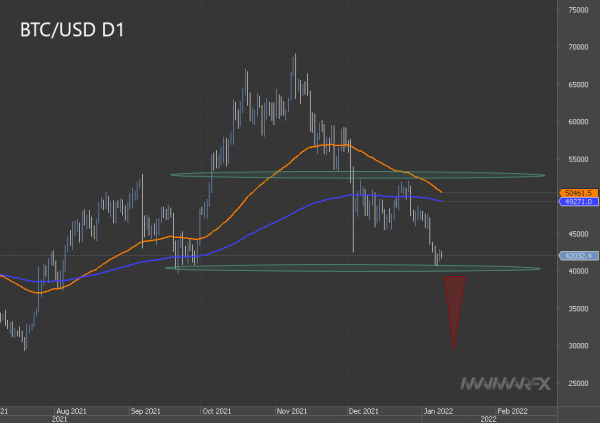

Bitcoin – Potential Flash Crash Toward $30,000?

Friday’s U.S. jobs report came in with only 199k jobs in December, less than half of the projections but the unemployment rate fell below 4 percent and wages jumped last month, adding to evidence of a tight labor market. Despite the disappointing payroll growth, the drop in the jobless rate and faster wage growth may justify a quicker tightening of monetary policy. The Federal Reserve could raise rates as soon as March.

U.S. dollar bulls took a backseat following Friday’s NFP report. This week’s focus now shifts to the U.S. CPI report due on Wednesday with headline inflation expected at 7.0 percent y/y in December and core at 5.4 percent. These would be the highest readings in 30-40 years. A higher-than-expected reading could further spur hawkish Fed monetary policy bets and thus bolster the dollar trade.

Technically, not much has changed in the EUR/USD and GBP/USD since our analysis from last Monday 3.1.

EUR/USD: The pair remains trading above 1.1270 and could aim for a test of 1.14/1.1420. A break above 1.1430 could result in accelerated bullish momentum toward 1.15. However, euro bulls are facing several resistances with risks being tilted to the downside given the divergence of monetary policy paths between the European Central bank and the Fed.

GBP/USD: Sterling bulls are trying to clear the 1.36-resistance level and if this happens, we see a higher target at around 1.3670. However most recently, the pair tends to trade in overbought territory, increasing the chances of a correction toward 1.3450.

Bitcoin – Drop to $ 30,000 becomes increasingly likely after a potential break below 40,000

With the Fed withdrawing stimulus and thus removing liquidity from the system, speculative assets are coming under pressure. In other words, cryptos are more vulnerable amid the Fed’s hawkish twist. A sustained break below 40000 could increase the chances of a flash crash toward 30000. Above 53000, the sentiment changes in favor of the bulls.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: