Brexit Saga Continues

We welcome you to the final ‘full’ trading week of 2020 which will be our last one ahead of the holiday season.

The British pound gapped higher after U.K. Prime Minister Boris Johnson and European Commission President Ursula von der Leyen agreed to continue Brexit talks in hopes of scoring a last-minute deal. While prospects of a deal have dimmed, pound traders have become hardened to countless missed deadlines and last-minute talks around Brexit.

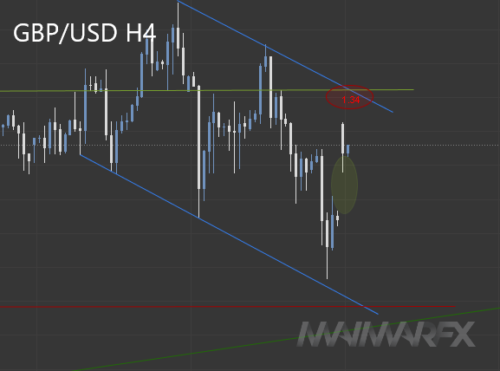

GBP/USD

The pound gapped up at the weekly trading open and our focus now turns back to the 1.34-barrier. We see prices still confined to a short-term downtrend channel which favors further bearish momentum if 1.34 proves to be challenging for bulls. However, we advise pound traders to take a cautious approach as price action could get messy as long as the Brexit saga continues.

EUR/USD: Recently, the pair remained trading within a sideways trading range between 1.2170 and 1.2060 but chances are still in favor of further bullish momentum. As long as the euro is able to hold above 1.21, traders eye the 1.22-level. On the downside, a break below 1.2080 could invigorate fresh bearish momentum until 1.2030.

DAX

We saw the index recovering its losses after dipping to a low of 13006 Friday. We now focus on the price area around 13250 which could act as a resistance. An upside break above 13300 would favor bullish momentum whereas bears may pay attention to a renewed break below 13100.

Talking points this week:

The Federal Reserve meets Tuesday and Wednesday, with markets widely expecting fresh guidance on its continued asset purchases. The Fed will release its latest economic projections but the tone is likely to be cautious and thus the outlook for the U.S. dollar is mainly neutral.

- Subscribe to our daily signal service

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2020 MaiMarFX.

Follow us on social media: