U.S. Dollar Weakness As The Main Driver For Euro And Sterling Gains

The U.S. dollar underperformed against its major counterparts last week amid elevated risk appetite.

The economic docket for this week is fairly light, which is why our focus will be on the technical picture, rather than on the fundamental backdrop.

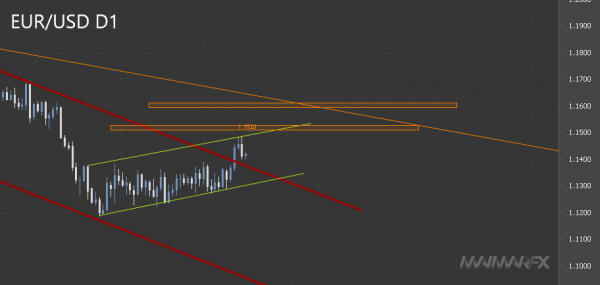

EUR/USD – Euro gains as a result of the greenback’s weakness

We got a bullish breakout with the pair exiting its recent downtrend channel and clearing the 1.14-resistance. The pair could now be creating a new short-term upward trend channel ranging from 1.15 to 1.13. Euro bulls that dream of a run for 1.16 should wait for an upside break above 1.1530. However, given the fact that the euro was a benefactor of broad U.S. dollar depreciation, rather than strength on its own merit, further gains might be on a shaky ground. For bearish momentum to accelerate and driving the euro back into sell-mode we would need to see a break below 1.1250 but more importantly below 1.12.

GBP/USD – Political instability has no impact on the British pound – at least not until now

While U.K. Premier minister Boris Johnson is facing a tough time, the pound benefits on a softer greenback and shows almost no reaction to a potential ousting of Boris Johnson. Since the pound posted an almost straight-lined upward movement, we expect a correction to happen soon. A break below 1.3650 could lead to a drop toward 1.36, a potential short-term support. We will then focus on a break below 1.3560 with a lower target seen at 1.35. On the upside and if the potential 1.36-support remains intact, the 1.38-mark could act as a resistance.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

We wish you good trades!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2022 MaiMarFX.

Follow us on social media: